-

In a best-case scenario, the money could wipe out almost one-third of the pandemic-related increase in missed payments, but it won’t exclusively be used for that purpose.

August 16 -

Financial institutions will have until early October to weigh in about new risk-based capital requirements for nonbanks.

August 13 -

The agency developed measures taking effect Aug. 31 that, among other things, will allow lenders to prioritize foreclosures of the most impaired loans and then focus on modifying salvageable ones.

August 11 -

The share of late payers who did not ask for COVID-19-related relief varied widely at 16 servicers surveyed by the the Consumer Financial Protection Bureau.

August 11 -

The two-pronged agreement also will add Figure's mortgage servicing rights onto Sagent's platform.

August 11 -

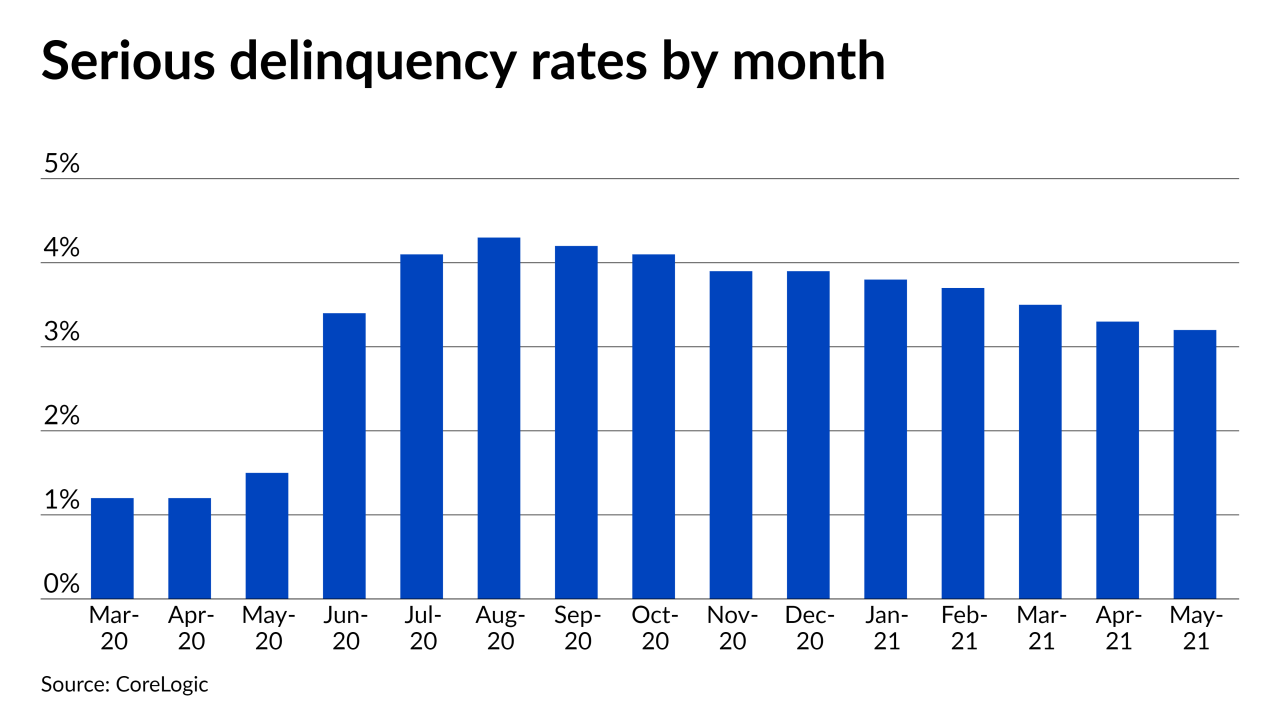

Trends on loans 90 days or more late on their payments reinforce other indicators showing the pandemic-driven growth in late payments is moderating, according to a new CoreLogic report.

August 10 -

Nearly half the country saw foreclosure starts rise year-over-year during the final month of the moratorium, according to Attom Data Solutions.

August 10 -

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10 -

Landlord groups have challenged the policy, arguing that the administration bowed to political pressure even though it knew the eviction freeze wouldn’t pass muster with the courts.

August 9 -

The congresswoman urged the Federal Housing Administration to double the six-month term it offers for more recent forbearance requests.

August 9