-

Prepayment speeds for loans included in agency mortgage-backed securities were up approximately 20% both monthly and annually during May as the decline in interest rates boosted activity, according to Keefe, Bruyette & Woods.

June 11 -

Economic strength bolstered the performance of loans included in commercial mortgage-backed securities with delinquencies improving for the seventh consecutive quarter, according to the Mortgage Bankers Association.

June 10 -

The use of financing to buy fix and flip properties increased 35% annually by dollar volume to its highest level in nearly 12 years, according to Attom Data Solutions.

June 7 -

Mortgage industry hiring and new job appointments for the week ending June 7.

June 7 -

The agency's vote Thursday threatens to block many of the industry's communications with customers, though banks did win one concession.

June 6 -

Fitch Ratings is considering making adjustments to property valuations used in sizing up private residential mortgage securitizations to better account for possible exposure to uninsured, catastrophic risks.

June 6 - LIBOR

The Mortgage Bankers Association created a template for originators to notify new borrowers when their adjustable-rate mortgage switches to a different index once publication of the London interbank offered rate discontinues.

June 6 -

Covius Holdings plans to buy several businesses from Chronos Solutions that support mortgage servicing and origination processes, including three delivery platforms that will increase the breadth of its technology offerings.

June 4 -

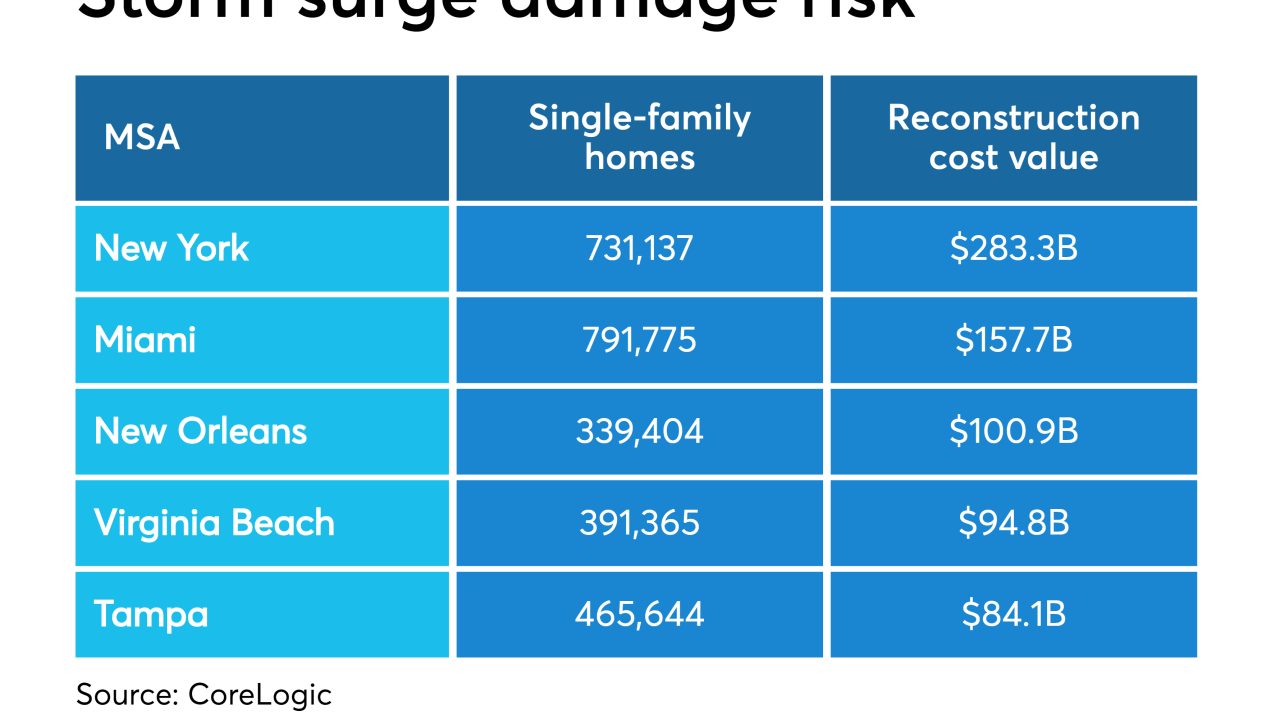

In the worst-case scenario, $1.8 trillion in reconstruction costs could result from coastal storms in 2019, even as hurricane experts predict a near-normal year for this season, according to CoreLogic.

June 3 -

Mortgage company merger and acquisition activity should continue to increase in 2019 as loan production costs rise and originations stay flat.

June 3