-

Mortgage industry hiring and new job appointments for the week ending Dec. 14.

December 14 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

Other than in areas hit by natural disasters, delinquency rates are falling with help from a healthier labor market, but a rise in riskier lending habits could signal trouble for borrowers should housing conditions change, according to CoreLogic.

December 11 -

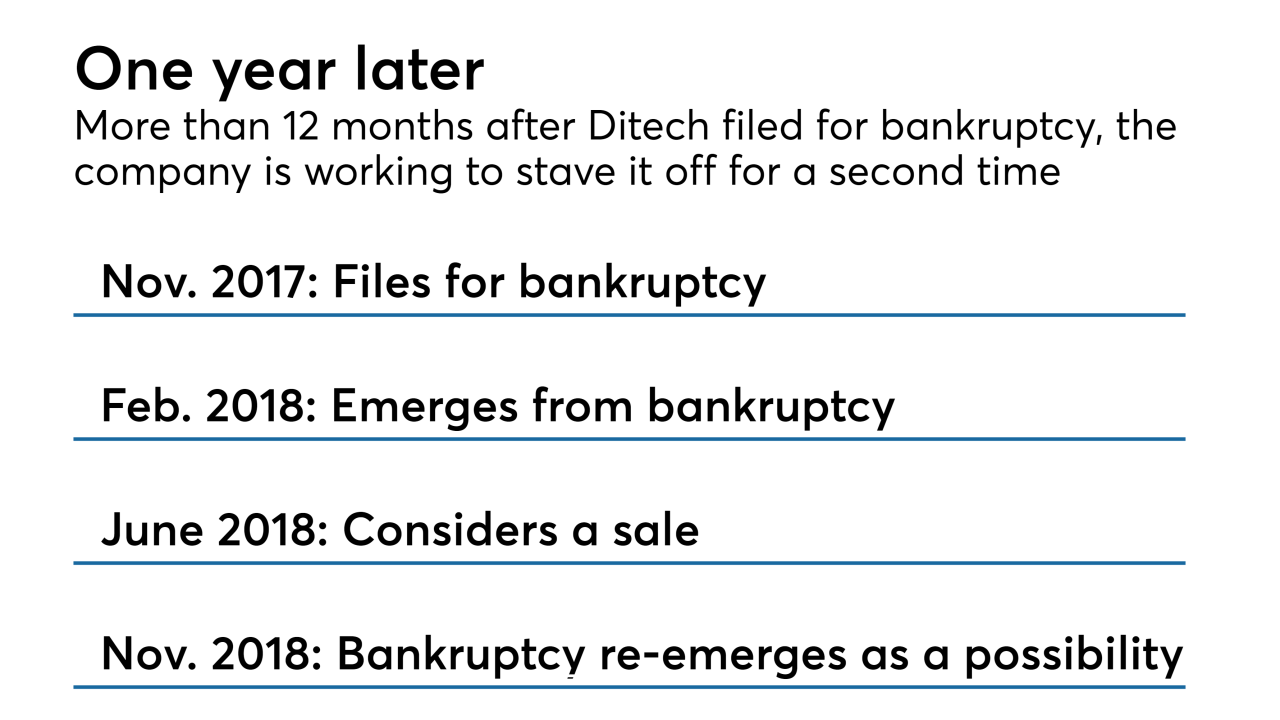

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

Weakening prices from the most expensive metro areas caused the first decline in available equity since the market started recovering from the housing crisis, according to Black Knight.

December 10 -

Casper's Parkway Plaza hotel has a new owner as GreenLake Real Estate Fund bid $15.5 million at a foreclosure sale to purchase the property.

December 7 -

New Penn Financial will change its name to NewRez at the start of 2019, reflecting its acquisition earlier this year by New Residential Investment Corp.

December 7 -

Mortgage industry hiring and new job appointments for the week ending Dec. 7.

December 7