-

The judge's order allows potentially thousands of consumers to join the lawsuit against the company, similar to other fights between borrowers and servicers.

December 22 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

A coalition of mortgagees said the zombie seconds law negatively impacts 1.2 million junior liens statewide, despite just over 500 potential "zombie" loans.

December 18 -

The Rithm affiliate that acquired Specialized Loan Servicing will pay $4.65 million, an amount that includes borrower restitution.

December 18 -

The deal significantly grows United Wholesale Mortgage's servicing portfolio, and it will increase the float on its common stock, making it more investable.

December 17 -

Higher unemployment has driven these indications of distress higher but most loans that financial institutions hold in their portfolios are still performing.

December 16 -

After home equity surged in 2023, average gains slowed last year before falling into negative territory over the past 12 months, Cotality said.

December 12 -

For 2026, the mortgage industry operating environment will improve, while nonbank financial metrics should be within Fitch's rating criteria sensitivities.

December 12 -

The new monthly reporting rule lists improved accuracy and timeliness of MBS payments among its goals, with implementation planned for February 2026.

December 12 -

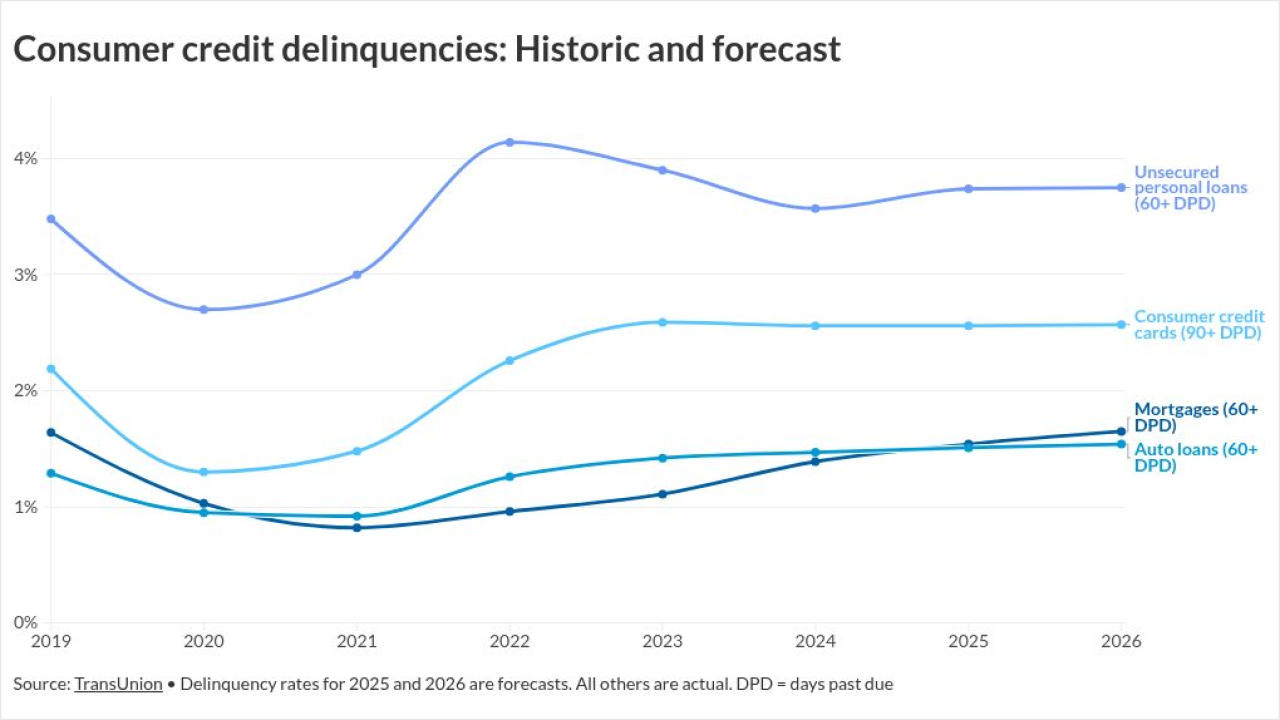

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10