-

Bayview Asset Management and three affiliates reached an agreement in a data breach lawsuit for an incident that impacted 5.8 million customers.

November 14 -

The acquisition agreement is the latest example of merger activity this year focused on the recapture potential held within servicing pipelines.

November 14 -

Origination has picked up but has limits, retention rates are improving and stakeholders are seeking a recapture standard, experts at an industry meeting said.

November 13 -

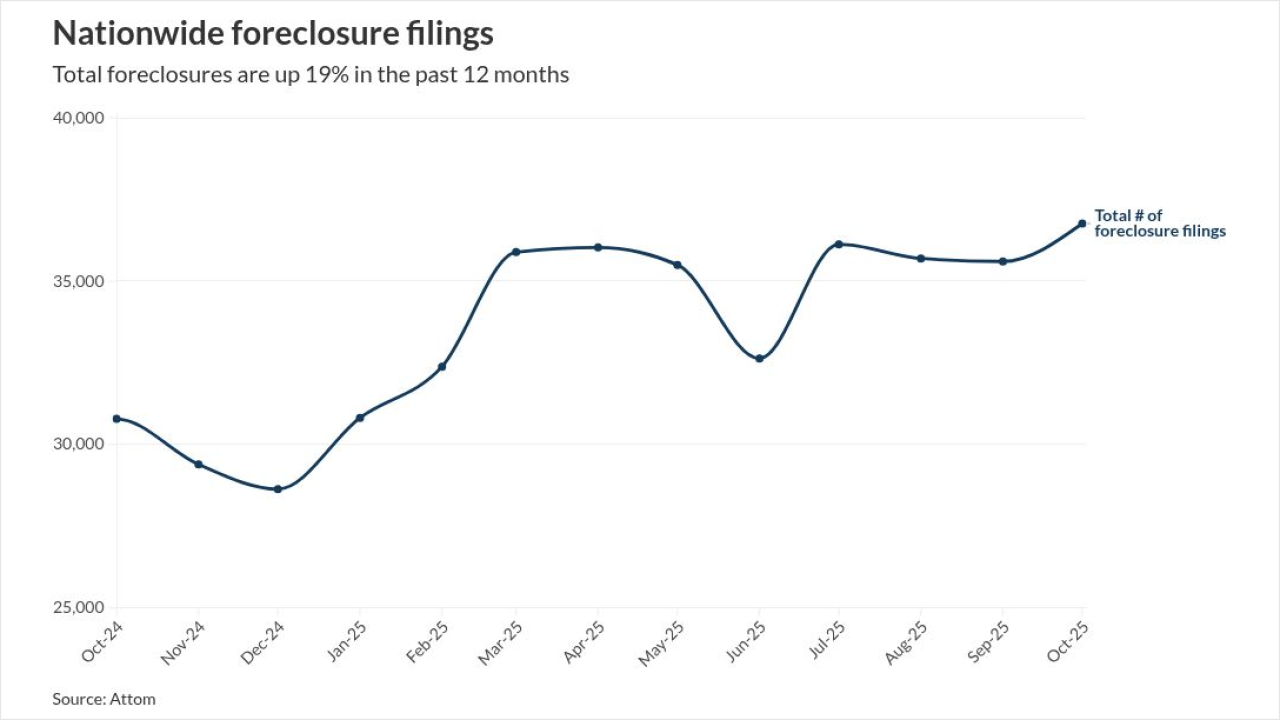

Total foreclosures rose 3% from September and 19% from the same time a year ago in October, marking the eighth straight month of increases.

November 13 -

Besides adding 60 days to the partial claim deadline in some cases, the bill also has provisions for buyer agent payments for Veterans Affairs borrowers.

November 12 -

Third-quarter mortgage earnings revealed swings in profitability, but the real story, according to the Chairman of Whalen Global Advisors, is that hedging MSRs is unnecessary for well-managed lenders.

November 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

The number of highly qualified refinance candidates rose to 1.7 million, the most in three and a half years, as mortgage rates ease.

November 10 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

UWM Holdings set a single-day record for rate locks in September at $4.8 billion, taking advantage of the window of opportunity leading up to the FOMC meeting.

November 6