-

The government securitization guarantor could move forward with more big-picture initiatives as well this year now that it officially has a confirmed president.

January 15 -

Foreclosure filings were reported on more than 360,000 properties in the United States last year, up 14% from 2025 and 3% from 2023, according to Attom.

January 15 -

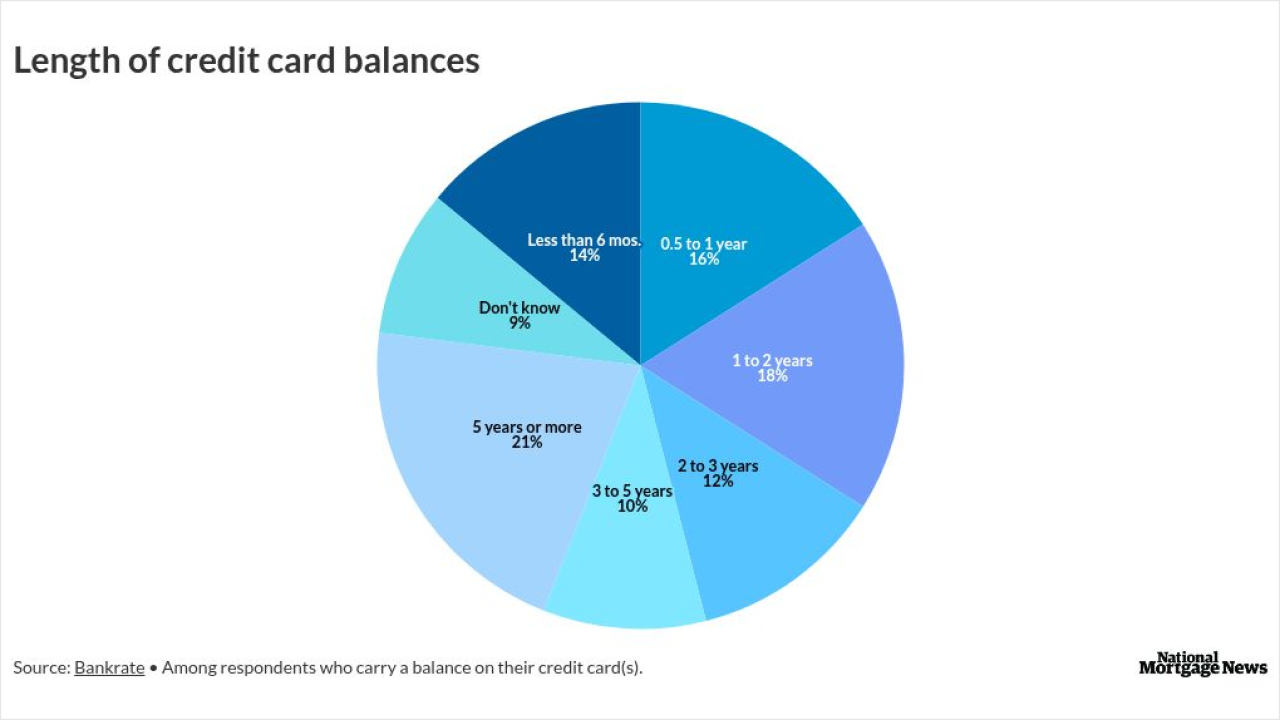

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

The Department of Housing and Urban Development is selling more due-and-payable HECMs on homes that are occupied while reviewing the loan program.

January 7 -

Wells Fargo, JPMorgan Chase, U.S. Bancorp and Citigroup will streamline borrower requests for an additional 90-day forbearance, allowing verbal applications.

January 6 -

Marshall is tasked with bringing Sagent's Dara servicing platform implementation up to scale, replacing Geno Paluso, who is vice chairman during the transition.

January 6 -

The impact of extreme weather remains top of mind for many, with a majority of homeowners citing it as a factor behind purchase or relocation considerations.

January 5 -

The Federal Home Loan Bank of Chicago will be offering more funding and higher per-member limits as part of its 2026 Community Advance program.

January 2 -

Fitch Ratings' outlooks for mortgage and title insurers this year are neutral, as housing deals with affordability challenges and a likely economic downturn.

January 2