-

Freddie Mac exchanged existing bonds from its portfolio for mirror certificates for the first time, completing a key test that is central to the creation of a uniform mortgage-backed security.

March 28 -

Independent mortgage bankers lost the largest amount for originating a loan in the fourth quarter since this data has been tracked, as costs rose and volume dropped, according to the Mortgage Bankers Association.

March 26 -

Ohio has become the latest state to start including mortgage servicing rights holders in its increased regulation of nonbank servicers.

March 20 -

Two Harbors Investment Corp., which grew its servicing portfolio by 22% in the fourth quarter, priced a common stock offering to raise funds to buy more rights as well as mortgage-backed securities.

March 19 -

Impac Mortgage Holdings saw its shift to predominantly originate non-qualified mortgage loans reduce its fourth-quarter GAAP net loss along with increasing its gain-on-sale margins.

March 15 -

Mr. Cooper Group took a net loss of $136 million in the fourth quarter after lower rates hurt the mark-to-market value of its larger mortgage servicing rights portfolio harder than its peers.

March 7 -

American Mortgage Consultants has acquired title search outsourcer String Real Estate Information Services as part of ongoing efforts to support all the services secondary-market clients need to conduct trades.

March 4 -

Altisource Portfolio Solutions recorded multimillion-dollar net losses in the fourth quarter and the full year for 2018, due to the reduction of the Ocwen Financial servicing portfolio and other repositioning activities.

February 26 -

Policymakers could improve independent mortgage banks' financial stability by giving these companies improved access to liquidity, according to the Mortgage Bankers Association.

February 25 -

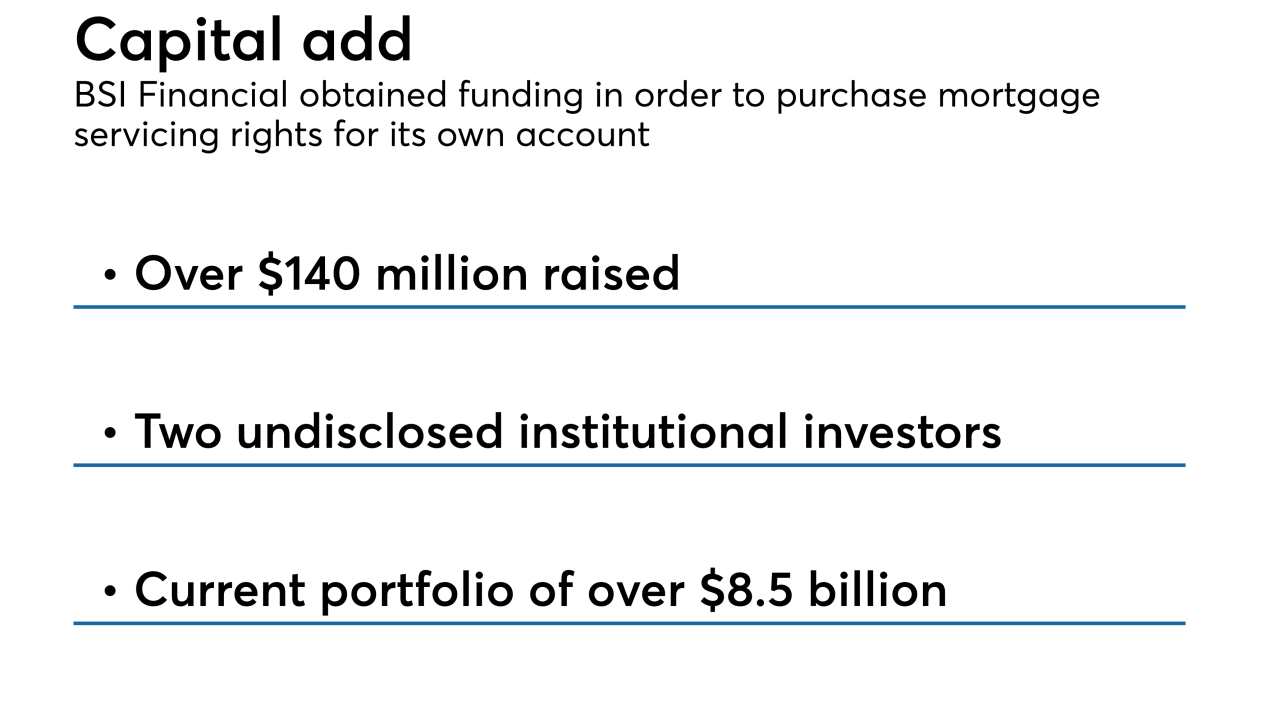

BSI Financial Services received a capital infusion for the subservicer to acquire mortgage servicing rights for its own account in order to offer its clients more liquidity for this asset.

February 22 -

The company disclosed that it paid $146 million for servicing rights associated with $13 billion in mortgages.

February 21 -

New Residential priced its second stock offering in four months, looking for gross proceeds of nearly $665 million.

February 20 -

HomeStreet Bank will attempt to sell its stand-alone mortgage business and portfolio of servicing rights, a move that comes amid growing pressure from an activist investor to exit home lending and concerns about declining demand and regulatory challenges.

February 15 -

Some hopeful souls in Washington believe the commercial banking industry will return to originating and servicing higher-risk mortgages, but most banks are more likely to continue withdrawing from the sector.

January 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Wells Fargo and JPMorgan Chase had reduced mortgage-related earnings in the fourth quarter as home loan activity continues to fall short of expectations.

January 15 -

Mr. Cooper Group is buying servicing rights on $24 billion in mortgages, a subservicing contract for an additional $24 billion in home loans and the Seterus platform from IBM.

January 3 -

New Fed Mortgage's pending acquisition of Commonwealth Mortgage LLC will allow it to expand its geographic footprint outside of New England.

January 2 -

Nonbank lenders are gearing up for new secondary market requirements and must make some difficult choices about whether to buy, sell or hold mortgage servicing rights, says Ruth Lee, the executive vice president of MorVest Capital.

December 28 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

Many servicers expect their Federal Housing Administration mortgage portfolios to grow in the next year or two, and that increase could coincide with an uptick in delinquencies, warns Altisource Portfolio Solutions.

December 21