With vaccinations underway and a larger stimulus package expected with the incoming Biden administration, Fannie Mae and Freddie Mac both improved their 2021 housing forecasts in January.

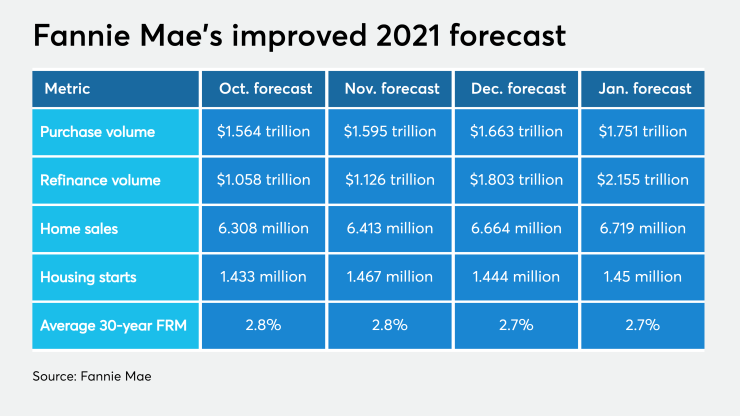

Fannie Mae projected an annual purchase volume above $1.75 trillion and expects that refinances will reach $2.16 trillion. Both figures are marked increases from

“COVID-19 remains the dominant force altering the path of the economy through the behaviors of people, businesses and policy makers,” Doug Duncan, Fannie Mae SVP and chief economist, said in a press release. “Therefore, the best policy for economic recovery is the broad distribution of an effective vaccine, which is underway. The sooner this can be successfully accomplished the sooner growth can accelerate, and our thought is that by midyear vaccine distribution efforts will be well-established, allowing for a strong second half.”

Fannie’s January forecast predicts a slight bump in yearly housing starts to 1.45 million from 1.44 million in December. Any upward momentum will help

“One impact of our projected growth acceleration is likely to be modestly rising interest rates, whether as a result of increased growth expectations — as consumer savings are augmented by stimulus leading to stronger consumer spending — or by a modest increase in inflation driven by demand growth outpacing a recovery in supply,” Duncan continued.

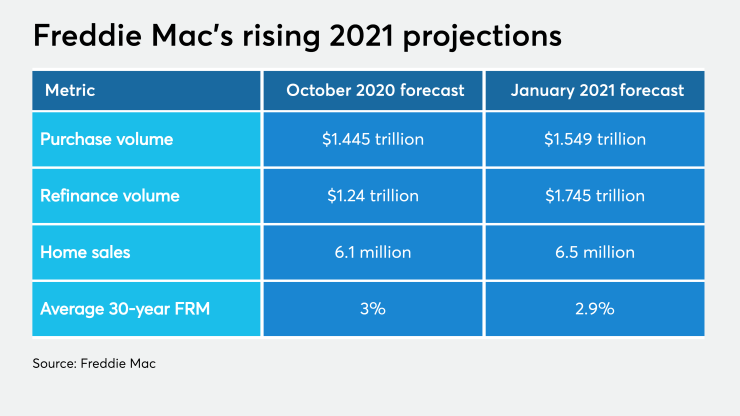

Freddie Mac’s latest quarterly forecast isn’t quite as rosy, but also provided much more optimism

Freddie expects 30-year interest rates to average 2.9%, down from 3% one quarter earlier. It projects about $1.55 trillion in purchase volume, $1.75 trillion in refinancing and 6.5 million homes sold. All three numbers jumped from the third quarter’s forecast of $1.45 trillion, $1.24 trillion and 6.1 million, respectively.

“Despite the uncertainties of the pandemic, the housing market performed well in the second half of 2020,” said Sam Khater, Freddie Mac’s Chief Economist. “Low mortgage rates and the ability to work remotely continued to support the demand for housing, which is reflected in home sales reaching levels not seen since 2006. Entering 2021, we anticipate a modest rise in rates that will likely affect refinance originations, which are coming off a remarkable year. We therefore forecast total originations to decline slightly to $3.3 trillion but remain strong this year.”