Credit score damage is a chief regret among consumers, but among financial goals it impedes, buying a home lies further down the food chain than other priorities, according to Debt.com.

Consumers' greatest financial regrets are related to credit scores, according to a recent survey by the debt-management and lead-generation company. Running up or maxing out credit cards was the main regret for 44% of consumers, and missing payments and damaging scores was the main regret for 23%.

"Credit scores impact many aspects of life from mortgages and auto loans to getting hired at a job you're applying for and in light of

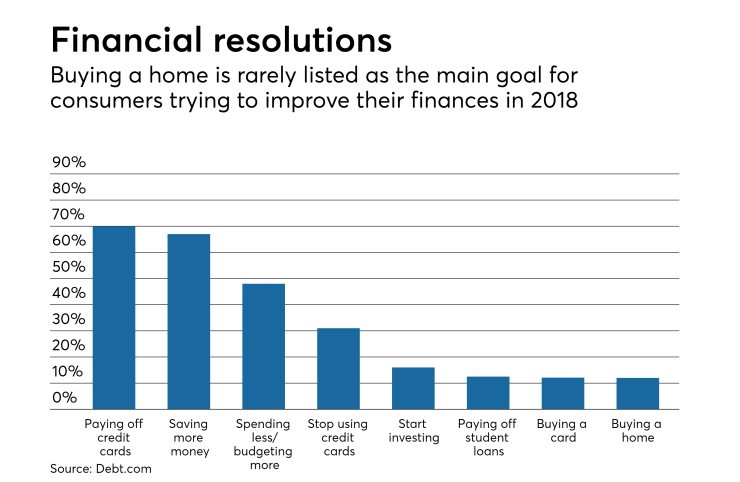

But when it comes to New Year's resolutions for 2018, home buying is a low priority when it comes to finances, according to the survey of more than 1,000 consumers.

While paying off credit cards ranks highest at more than 70%, buying a home ranks lowest at less than 12%.

Other financial goals consumers are more interested in this year include saving more money (67%), spending less and budgeting more (48%), stop using credit cards (31%), and start investing (16%).

Drawing only slightly more interest as a goal than purchasing a home is buying a car (a little over 12%) and paying off student loans (approaching 12.5%).

More than half of consumers in the survey skipped a question about whether they have met past financial goals, but among those who answered it, more than 36% said they have and more than 63% said they have not.