Credit cards

Credit cards

-

President Donald Trump's support of legislation that would cap credit card interest rates at 10% has flagged in recent weeks, but experts say that the debate has highlighted significant gaps in regulators' understanding of the credit card market and how its risks are priced.

February 3 -

President Trump in Davos, Switzerland, talked about his call for lower credit card interest rates and more affordable housing in a lengthy speech that mostly focused on his plan to take over Greenland.

January 21 -

Bilt's new card caps interest rates at 10% for one year and Affirm is adding BNPL for rent as analysts predict the political environment will benefit fintechs.

January 16 -

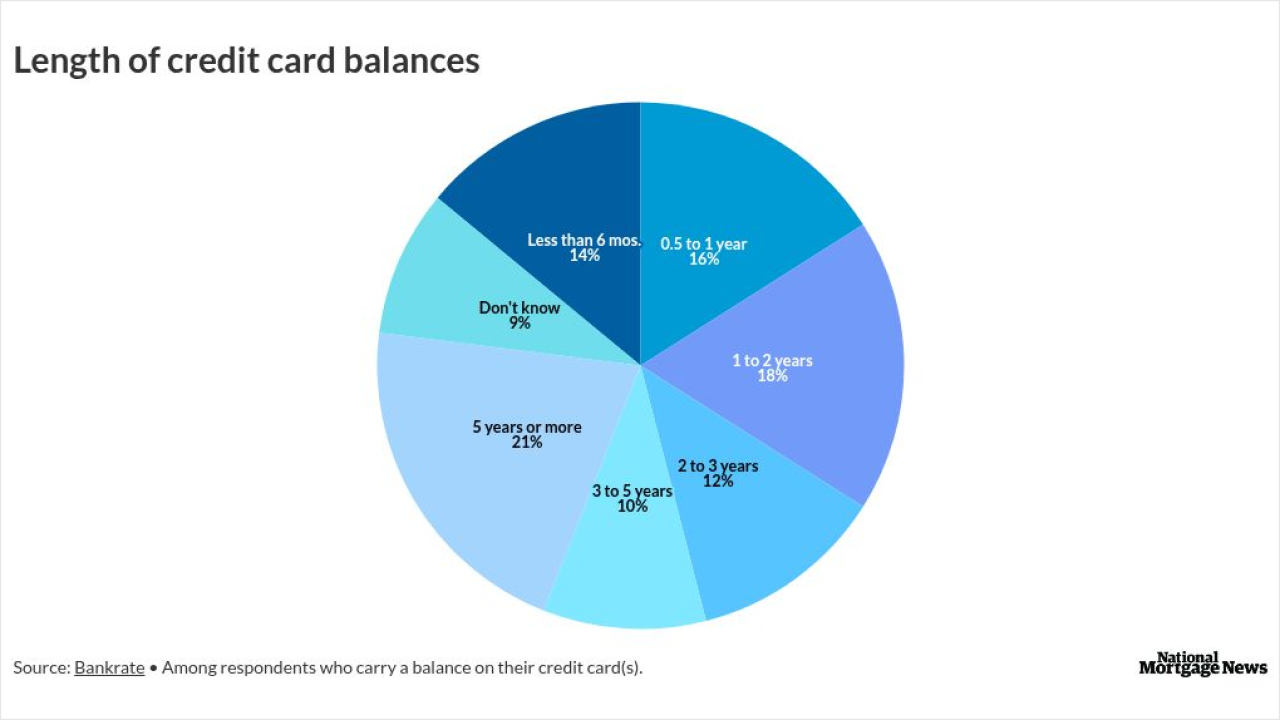

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

Bank statement loans, a home equity credit card and a blockchain investment product are among the new offerings designed to reach an $11 trillion market.

December 5 -

The credit card will provide borrowers points for making their normal monthly mortgage loan payments and for the purchase of home products and services.

November 21 -

Late-payment rates among U.S. borrowers rose again in the second quarter, according to a report from the New York Fed. The trend reflects a sharp increase in student loan delinquencies, which have been climbing as pandemic-era policies have expired.

August 5 -

Mounting liabilities are raising the stakes for an economy that has come to rely more and more on high-end consumer spending to power expansion.

July 29 -

New self-regulatory guidelines for credit cards and checking accounts are arriving at a time of deregulation in Washington, D.C.

June 25 -

Rocket Companies and Mesa have both launched credit cards geared that offer homeowners perks and points for paying their mortgage and buying housing-related items.

May 30 -

The post-pandemic increase in consumers falling behind on their credit card bills seems to be tapering off. "For 2025, we're seeing a lot of stability in delinquencies," an industry researcher said.

December 13 -

Investment banking fees shot up at the nation's largest bank, thanks to rebounds in M&A and the equity capital markets segment. And despite higher credit costs in the company's card business, a top bank executive expressed confidence in the health of U.S. consumers.

July 12 -

A proposal from the Consumer Financial Protection Bureau to extend the same protections as credit cards to the fast-growing BNPL industry aims to protect consumers, but it could also stunt the nascent industry's growth, experts say.

June 4 -

The retail giant has scrapped its credit card partnership with Capital One, its second public spat in recent years with a partner bank. Analysts say it may be a sign that Walmart wants to launch its own credit card on what it hopes will be a financial super-app.

May 29 -

The number of borrowers who are at their credit limits is approaching its pre-pandemic level, and the percentage of balances that are sliding into delinquency has hit its highest rate in more than a decade, according to new research. Still, card companies are generally expressing optimism about their credit outlooks.

May 14 -

Net charge-offs at the Charlotte, North Carolina-based bank increased by more than 80% in the first quarter compared with a year earlier. BofA executives say that the rising losses were in line with the bank's risk appetite.

April 16 -

The blockbuster merger proposal will be reviewed at a time when the Biden administration is expressing skepticism about consolidation. Its analysis will have to account for markets dominated by both big banks and the likes of Visa and Mastercard.

February 20 -

Too few lenders are underwriting unsecured consumer debt, which could help borrowers pay down credit card balances with little risk to lenders.

December 11 -

As U.S. credit card balances continue to march above $1 trillion, the number of newly delinquent credit card users now exceeds the pre-pandemic average and millennials and those with student or auto loans are driving the increase in past-due payments, the New York Fed said.

November 7 -

As the holiday shopping season approaches, late payments on credit cards have surpassed their pre-pandemic levels, according to a new VantageScore report. The consumers showing signs of deterioration include not only subprime borrowers, but also those with prime credit scores.

October 31