Arch Capital Group Ltd.'s mortgage insurance business had second-quarter underwriting income of $184 million, up 343% from the $41.4 million for the

The most recent results include Arch's purchase of United Guaranty Corp. from American International Group, which was completed on Dec. 31, 2016. UGC had underwriting income of $151 million in the second quarter last year, according to AIG's results from that period.

On a pro forma basis, the combined underwriting income for the second quarter last year was $192.4 million, resulting in a decline of nearly 5% on a year-over-year basis.

In

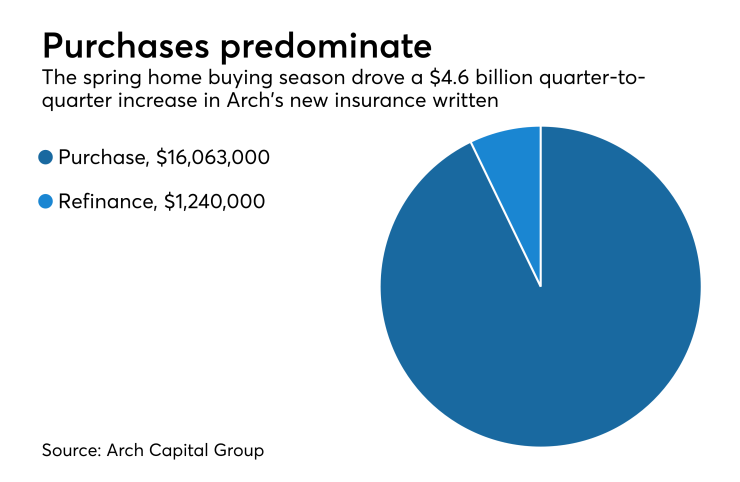

Arch had $17.3 billion of new insurance written in the second quarter, compared with $12.7 billion in the first quarter. The spring home purchase season was the driver of the quarter-to-quarter improvement, the company said in a press release.

Nearly 93% of NIW came from purchase loans, with just 7% from refinancings. In the first quarter, purchase loans made up 85% of NIW.

For the second quarter last year, Arch did $6.4 billion of NIW, while UGC did just under $13 billion.

Arch includes its international mortgage insurance and reinsurance operations, as well as credit risk sharing agreements with the government-sponsored enterprises in this segment. Total insurance-in-force at the end of the quarter was $332.9 billion, of which $244.2 billion was from Arch MI U.S.

Arch paid claims on 2,111 policies, the bulk of which came from UGC's portfolio. For the second quarter last year, Arch paid 193 claims. When Arch acquired UGC, its delinquent loan inventory swelled to 29,691 on Dec. 31, 2016 from 2,423 loans at the end of the third quarter. The inventory is currently at 23,902 loans.

It paid $85.5 million on this year's second-quarter claims versus $7.2 million one year prior.

Arch Capital Group's net income was $173.8 million, down from $205.6 million for the same period last year. Even as the mortgage insurance results benefited from the UGC deal, its insurance segment (which among other lines includes insuring the construction industry and automobile lenders, plus directors and officers and errors and omissions coverage) had a $4.5 million loss for the quarter (down 206% from 2016), while its reinsurance segment had underwriting income of $19 million, down 74% from the previous year.