While the industry continues adopting digital mortgage methods, homebuyers expect to be able to apply for a mortgage and complete the application online, but still want human interaction, according to Ellie Mae's 2018 Borrower Insights Survey.

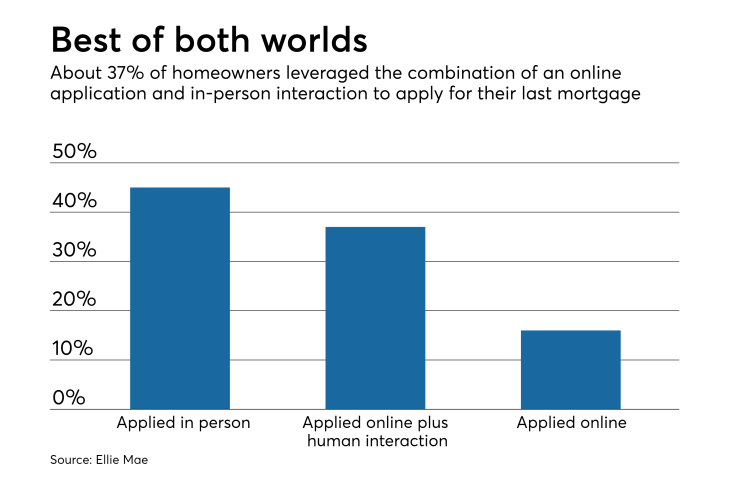

About 16% of homeowners applied for their most recent mortgage completely online, while 45% applied entirely in-person, and 37% of borrowers utilized a combination of an online application and in-person interaction.

By generation, 75% of

And even though millennials were most likely to take advantage of online mortgage applications, they were also most likely to want more lender interaction.

"The trend toward online is a great opportunity for mortgage lenders. As lenders embrace a true digital mortgage, borrowers will get the benefit of both a high-tech process to make things go faster, and a human-touch experience, providing transparency and building their confidence," Joe Tyrrell, executive vice president of corporate strategy at Ellie Mae, said in a press release.

"A true digital mortgage that encompasses all aspects of the process enables lenders to dedicate their resources toward building valuable relationships with borrowers and guiding them through the process, instead of spending time clicking buttons or validating data. High tech and human touch are equally important," he said.

Digital mortgage components for borrowers are not confined to filling out an application, as they are also involved before and after the application process. About 31% of homeowners conducted mortgage research online before applying, and 21% found their lender through an online search. After the initial application, 19% of homeowners referenced online tolls for loan origination and 8% used an online resource after closing the loan.

Ellie Mae's Borrower Insights Survey results were shared at its Experience Conference Tuesday in Las Vegas.