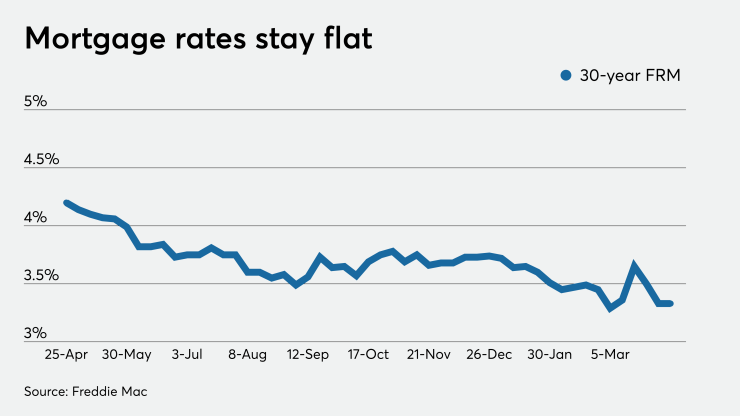

Mortgage rates remained flat from last week, but are expected to fall further as they continue to lag changes in 10-year Treasury yields, according to Freddie Mac.

The 30-year fixed-rate mortgage averaged 3.33% for the week ending April 9,

"While mortgage rates remained flat over the last week, there is room for rates to move down," Sam Khater, Freddie Mac's chief economist, said in a press release. "This year the 10-year Treasury market has declined by over a full percentage point, yet mortgage rates have only declined by one-third of a point. As financial markets continue to heal, we expect mortgage rates will drift lower in the second half of 2020."

The 15-year fixed-rate mortgage averaged 2.77%, down from last week when it averaged 2.82%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.6%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.4% with an average 0.3 point, unchanged from last week. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.8%.

"Mortgage rates fell sharply over the last seven days, with big declines early in the week tapering off into more gradual reductions in recent days. Rates have been relatively stable lately — at least by recent standards — suggesting that the historic intervention by the Federal Reserve has at least partially achieved its goal of easing market volatility and ensuring the trains keep running. But looking at average levels on only conventional loans only tells part of the story," according to Zillow economist Matthew Speakman.

"The mortgage industry remains under significant stress, as forbearance programs enacted to support borrowers grappling with coronavirus fallout also greatly increase risks elsewhere in the industry and unintentionally place a huge burden on servicers who now have to continue paying investors — essentially being asked to keep filling the pot, despite no water coming in. The threat of missed payments also introduces the potential for greater risk for lenders, resulting in tighter lending restrictions and a less-active market for non-agency and less conventional loans," Speakman said in note that accompanied the release of Zillow's own rate tracker.