WASHINGTON — The federal banking agencies denied several appraisal organizations’ request for a public hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

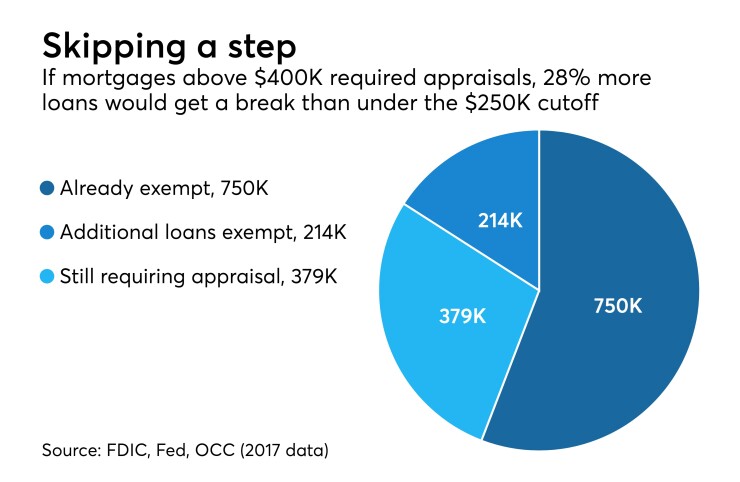

In November, the Federal Reserve, the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency

In releasing their proposal, the agencies claimed it would make appraisal requirements less burdensome without threatening the safety and soundness of financial institutions.

But appraisers have argued that that change

The regulators told the appraisal groups Feb. 7 that the comment process was sufficient for members of the public to express their views on the proposed rule.

“After reviewing your letter and considering the discussion in our conference call, we do not believe that holding a public hearing would elicit relevant information that could not be conveyed through the comment process,” the agencies said in their letter to the organizations. “While the agencies are, therefore, declining your request for a public hearing, we will carefully consider your written comments.”

The American Society of Appraisers in particular objected to the regulators’ denial of a public hearing, citing the agencies' decision two years ago to not change the threshold after four rounds of comment periods and six rounds of public hearings.

“Despite myriad good reasons NOT to increase the threshold, the agencies will instead enact a regulation that harms homebuyers and runs directly counter to Congressional intent,” Robert Morrison, the appraiser group's president, said in a statement. “This, to me, is the definition of an agency acting in an arbitrary and capricious manner."

The comment period for the notice of proposed rulemaking closed Feb. 5.