Market reaction to

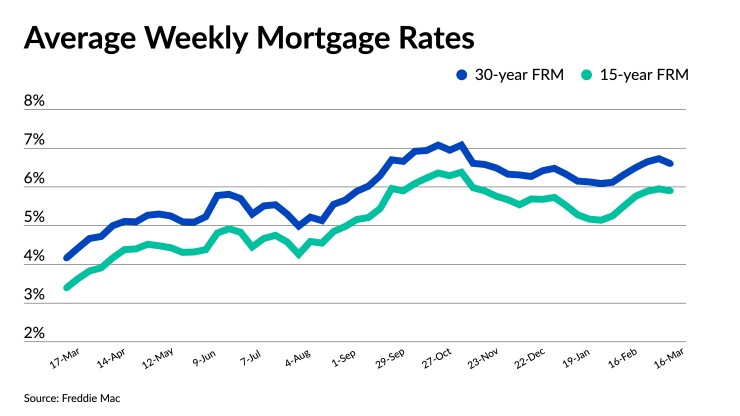

The average 30-year fixed mortgage rate fell 13 basis points to 6.6% for the seven-day period ending March 16, according to Freddie Mac's weekly Primary Mortgage Market Survey.

The 15-year fixed rate averaged 5.9%, coming down from 5.95% one week ago. The current rate is now over 2.5% percentage higher than its level in mid March 2022.

"Turbulence in the financial markets is putting significant downward pressure on rates," said Freddie Mac Chief Economist Sam Khater in a press release.

Banking industry turmoil over the past seven days leading to government

A gradual recovery early this week came to a halt on Wednesday, as news spread of troubles at global banking firm

The events of the past several days have now thrown recent rate forecasts largely

Before last weekend, many

Heightened uncertainty is leading "economic actors to pull back on spending, investing and flee to safety," said Orphe Divounguy, senior macroeconomist at Zillow Home Loans. "As a result, longer-term yields – including mortgage rates — are declining,"

"Going forward the Fed will have to advance its goal for price stability while also limiting financial stability risks," she said.

The spotlight is now thrown on the next meeting of the Federal Open Market Committee, scheduled for March 21 and 22 when central bank officials will make its next rate-hike decision. Despite the upheaval over the past week, there's still potential for a 25 basis point increase, some

Regardless of the outcome, further rate volatility should come as no surprise after the meeting, according to Divounguy.

The current pullback in rates, though, could lead consumers back to the market in the short term, according to Khater. Purchase applications picked up at the end of last week, according to the

"During times of high mortgage rate volatility, homebuyers would greatly benefit from shopping for additional rate quotes," he said.