Just a day after online lender Better.com amended a merger agreement to

The staff reductions involved workers in both the U.S. and India, but the breakdown by location was not disclosed. However, the majority of those losing their jobs came from the refinance-focused production staff, as originations for that purpose are expected to decline in 2022.

Better also has a non-mortgage staff that provides real estate sales, title and settlement services, and homeowners insurance, and is shifting its focus toward enhancing the home purchase experience.

"A fortress balance sheet and a reduced and focused workforce together set us up to play offense going into a radically evolving homeownership market," said Kevin Ryan, its chief financial officer, in a statement.

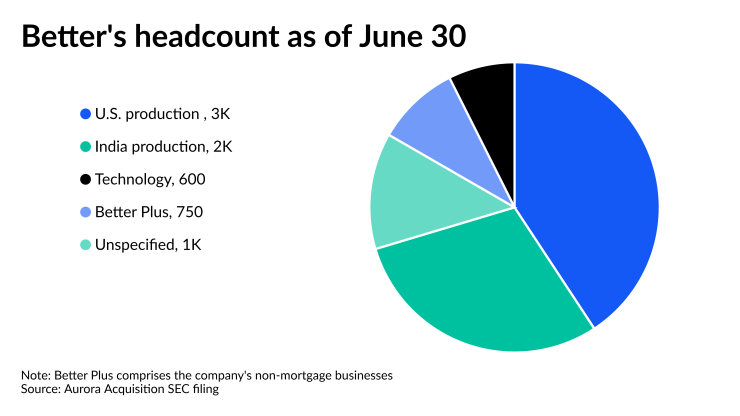

At the start of the year, the company had approximately 5,000 employees. According to the prospectus for the SPAC transaction, Better had 5,000 employees in the U.S and another 3,100 in India as of June 30. Approximately 600 work in technology and product development, nearly all being located in the U.S. Another approximately 5,700 people work in production roles, approximately 3,300 in the U.S. and approximately 2,400 in India.

Just prior to the layoffs, which were effective immediately, Better had approximately 10,000 employees.

Better just restructured its merger agreement with Aurora Acquisition to add $750 million in cash to its balance sheet right away, via a convertible note, with the opportunity to add another $750 million after the transaction closes. With this new funding, the company will have $1 billion in cash and cash equivalents on its balance sheet.

In a press release issued after the market closed on Nov. 30, Better CEO Vishal Garg talked about how the company doubled its market share over the past 12 months as its competition has stayed in place or started to retrench. "This is exactly the time for us to lean in and accelerate our customer-focused product innovation, and grow our B2B business, which we believe provides us with greater defensibility in a tougher mortgage market," he said.

Garg also talked about other mortgage lenders scaling back their automation and vertical integration efforts. Indeed, the new funding gives Better the opportunity to expand its business.

In the

The Better layoffs followed news of