Black homeownership rates in each of the nation's 50 largest metro areas has been smaller than population share in those regions, a LendingTree study recently found.

The disparity was greater in those cities with a larger Black population, which is likely a residual effect of the institutionalized racism which existed for many years, including the

In the aggregate, Blacks make up an average 14.88% of the population in these cities, but only own 10.02% of homes, according to LendingTree's analysis of

But for whites in the same cities, even though they make up 58.21% of the residents, the share of owner-occupied properties is 70.51%.

The gaps can be traced back to Jim Crow laws and/or real-estate redlining, Channel said.

"The historical legacy of this kind of discrimination — which was legal and now fortunately it's not — still has a lasting effect decades later," he said.

Salt Lake City was the metro area with the smallest difference between the population and homeowner share, at 111 basis points. However, the city's share of Black residents was just 1.68%. Black households have represented 0.57% of all people that own a home there.

Similarly San Jose, California's difference was 122 basis points, with 2.37% of the city's population consisting of Black residents and that demographic representing a 1.15% share of owner-occupied units in the region.

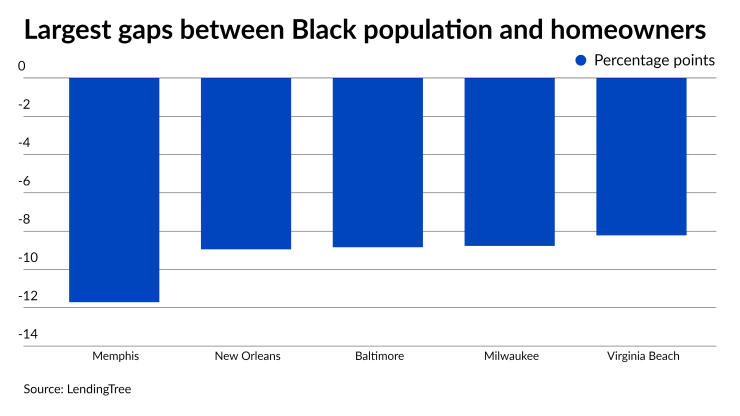

Memphis, Tennessee, the city with the largest share of Black residents at 46.7%, had the biggest disparity when it came to owning a home, at 1,171 basis points. The Black homeownership rate in the city was just under 35%.

In New Orleans, Black households made up 33.37% of the population but just 24.42% of them owned homes, for a gap of 895 basis points. Baltimore's difference was 884 basis points, with its Black population representing 28.78% of the total, and just 19.94% of these households living in properties they own.

A metropolitan area like Salt Lake City has long had a small Black population, so historic discrimination doesn't loom as large for it as it does for cities like Memphis and Baltimore, Channel noted.

Channel said the confirmation of historical patterns left him "disheartened, knowing the fact that this issue is still so prevalent, despite the fact that redlining is illegal now, housing discrimination is illegal now."

The numbers point to the challenge faced by agents of change like

Nationwide, Blacks only owned 41.9% as of the end of 2020, the U.S. Census Bureau found. Going forward, without any intervention, that rate is expected to fall to 41.1% by 2030 and 40.6% by 2040, the Urban Institute added at the time the initiative was started.

Last year, the Mortgage Bankers Association, as a member of the collaborative and in conjunction with the National Fair Housing Alliance, came out with

Channel said the collaborative's goal is achievable, but not unless some heavy lifting is done.

"Generally society will have to continue to put more pressure on lenders to ensure that their loan originators are going through the appropriate anti-bias training, that people they work with, like appraisers, are going through anti-bias training, as well as ensuring that there are opportunities for Black buyers," Channel said. "That often means creating more opportunities for people who have less wealth or lower credit scores."

That could be where the

But the cities themselves also have to be involved in the effort.

"Similarly, pressure needs to be put on these metro areas, to say, 'Okay, this was an area that was historically redlined, let's ensure that it's getting proper investment,'" said Channel.

That includes making more investments in infrastructure or other aspects of communities that help increase home values or make it more appealing and practical for people to buy in those locations.

"The running theme of what I found in my research is that a lot of this is rooted in the historical legacy of racism," Channel said. "And if you look, it's much easier to pass wealth along if your family has been allowed to have wealth for generations and generations."

It wasn't all that long ago that people of color were not allowed to own homes in certain areas or legally be denied a mortgage. April 11 will be

"That's, I think, a big part of why homeownership rates are so proportionately low and then by extension, wealth in the Black community is also so low because it is worth noting that, for most households, their house is the biggest portion of their overall net worth," Channel said.