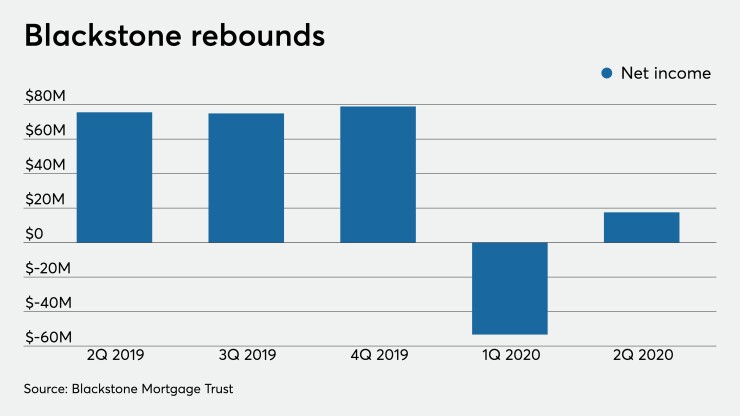

After a down opening to 2020, Blackstone Mortgage Trust improved its earnings, pulling in over $17.5 million in the second quarter from a loss of $53.4 million in the first. But the second quarter’s earnings pale in comparison to the $75.2 million logged a year ago.

Blackstone posted a core earning — a metric excluding the effects of transactions and GAAP adjustments, like credit loss reserves and noncash compensations — of $85.2 million, down slightly from $86.5 million quarter-over-quarter.

Overall, the New York-based commercial real estate finance company raised its liquidity to $1.33 billion, up 60% from $836 million in the first quarter.

"Blackstone Mortgage Trust’s key advantages — our $18 billion senior mortgage loan portfolio, well-capitalized balance sheet and market-leading real estate platform — all contributed to our strong second quarter performance," Stephen Plavin, CEO of Blackstone Mortgage Trust, said in a press release.

That portfolio of senior mortgages accounted for $386 million of loan repayments and $317 million of loan fundings during the second quarter and has a weighted average origination loan-to-value ratio of 64%.

"We again collected 100% of borrower interest while raising $607 million of new capital and increasing our liquidity to $1.3 billion," Plavin said. "BXMT is very well positioned to protect its assets and originate new loans as transaction activity rebuilds.”

The company posted GAAP earnings of $0.13 per share in the second quarter of 2020 compared to $0.59 the year prior and -$0.39 in the first quarter. The per share core earnings came to $0.62 and the book value stood at $26.45 per share. In the first quarter, those reached $0.64 and $26.92, respectively.