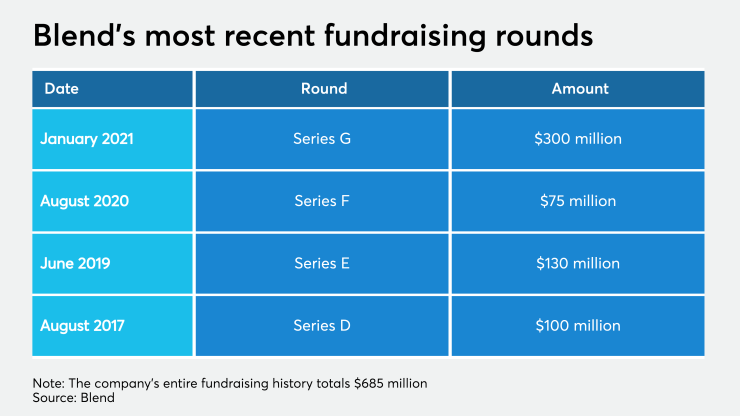

Digital lending platform Blend secured $300 million in Series G funding from a group of investors led by Coatue and Tiger Global Management.

With the windfall comes an estimated valuation of $3.3 billion — almost double from five months prior. Blend President Tim Mayopoulos credits the exponential growth to the company’s increased revenue and

“With stiff competition from digital-first lenders and fintechs, plus consistent threats of big tech moving into financial services, financial institutions are continuing to prioritize technology to help them win and keep customers,” Mayopoulos told National Mortgage News. “This will be especially true heading into a year where there is more uncertainty about the economy and the real estate and broader lending markets.”

Founded in 2012, Blend now covers approximately 30% of the U.S. mortgage market, according to its press release. In 2020, the company increased its headcount by 60% and facilitated over $1.4 trillion in mortgage and consumer loan volume through its digital lending platform. The company reports that around 270 lenders use its technology. It counts US Bank, Wells Fargo, Truist, Navy Federal Credit Union, Fifth Third Bank, Huntington, M&T Bank and BMO Harris Bank among some of its largest customers.

Blend plans to use the latest fundraising to

The build-out will prioritize

Lendsmart founder and CEO AK Patel, whose AI-driven underwriting and communications software company was

“They are overleveraged, hence why they have raised big rounds, the company has never generated a profit. Seems like they are going down the Amazon route to dominate the market,” Patel said. “I think they are on the route to become a neo bank.”