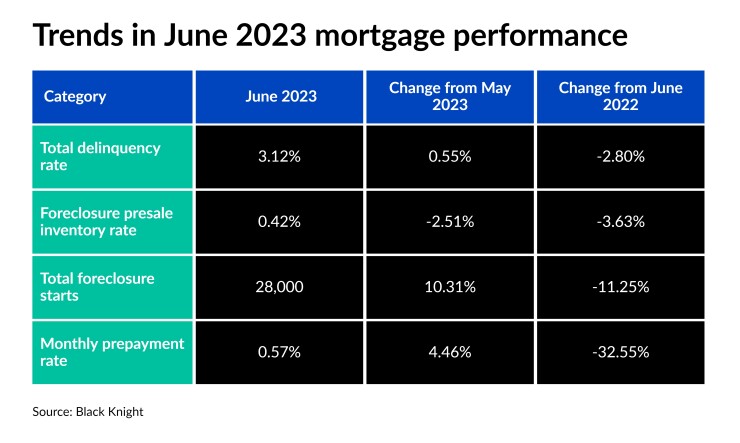

Borrowers recorded the third-lowest national delinquency rate on record to end June despite some

The nation's overall delinquency rate was 3.12% in June, a 2.8% decline from the same time last year, the company said Friday in its First Look report. The performance was boosted by the number of serious delinquencies approaching a 17-year low, falling to 471,000 such loans nationwide last month.

The declines line up with borrowers at-large getting back on track with loan payments, as many mortgage holders who went into forbearance during the pandemic have

June's serious delinquency count was 13,000 fewer late mortgages than May, and 177,000 loans less than the same time last year, Black Knight said. Shorter-term delinquencies between 30-to-60 days late rose last month, driving the national rate up 0.55% month-over-month.

The number of borrowers who missed their first payment rose 2.2%, or by 19,000 mortgages, while the number of loans 60 days or more past due rose by 5,000, representing a 1.7% jump. Nationwide, a combined 1.65 million properties are 30 or more days past due, Black Knight found.

The country's monthly prepayment rate sat at just 0.57%, with a slight 4.46% increase from May. Prepayments however are still down 32% from the same time last year, Black Knight found.

Borrowers in Southern states are struggling with the nation's highest delinquency figures, topped by the 7.4% of Mississippi loans with late payments. Meanwhile, Pacific Northwest states tout the lowest delinquency rates, led by Montana's overall 2.15% mark.

Black Knight's report analyzes the firm's loan-level database, and it extrapolates data to calculate its statistics.