Lower rates and signs that more affordable housing inventory is being built drove Fannie Mae's 2019 origination numbers higher in its latest forecast.

The government-sponsored enterprise also revised its total origination figure for the past year upward based on newly released Home Mortgage Disclosure Act data.

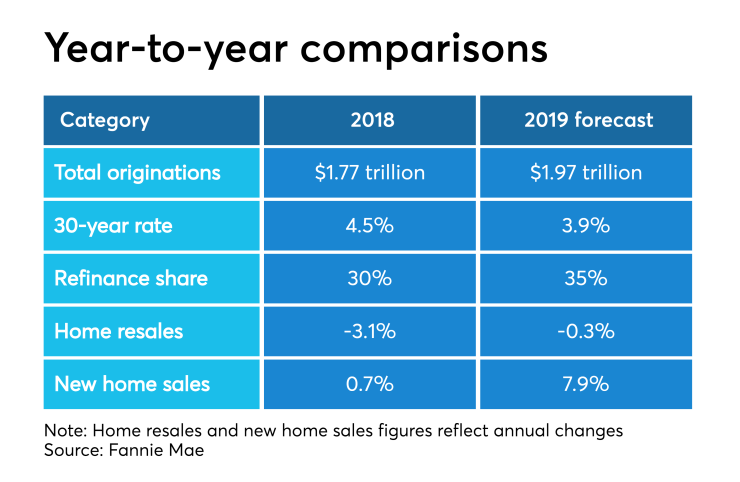

Fannie's new estimate for 2018 is $1.77 trillion and its revised estimate for 2019 is $1.97 trillion. Last month Fannie forecast that there would be $1.84 trillion of home loans originated in 2019, and estimated that lenders produced $1.64 trillion last year.

"Both

Despite the increased optimism among consumers and lenders, the rate at which Fannie expects originations to grow year-to-year is slightly lower than forecast the previous month at 11%. This is in part because the 2019 home resale outlook is now worse due to supply issues.

Overall, Fannie's outlook on housing and the economy remain mixed.

"Domestic economic data continue to paint a picture of generally positive fundamentals amid a backdrop of continued volatility and uncertainty," Duncan said. "Consumer spending remains the engine driving the economy forward, but faltering business investment and worrying downside risks, including the ongoing trade tensions between the U.S. and China, could become a heavier weight on growth."