-

Federal Reserve Gov. Lisa Cook said in a speech Wednesday night that the central bank's credibility depends on its ability to bring inflation back to its 2% target.

February 4 -

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

February 4 -

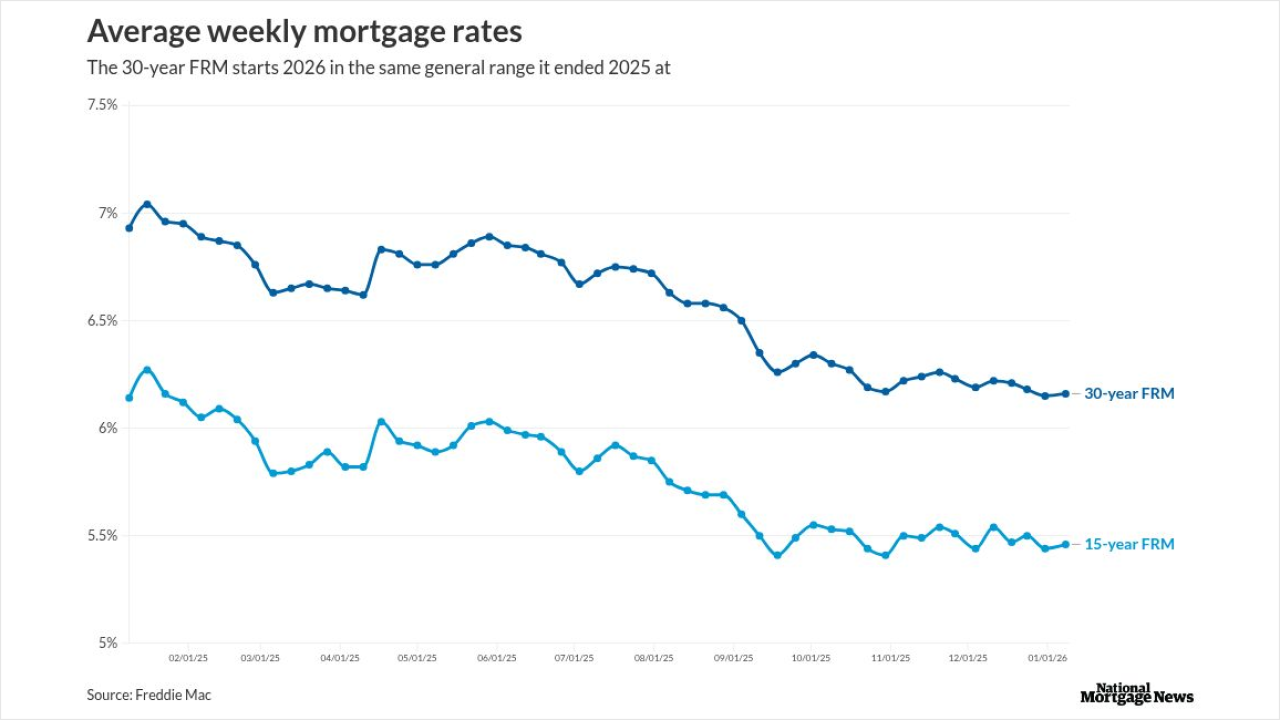

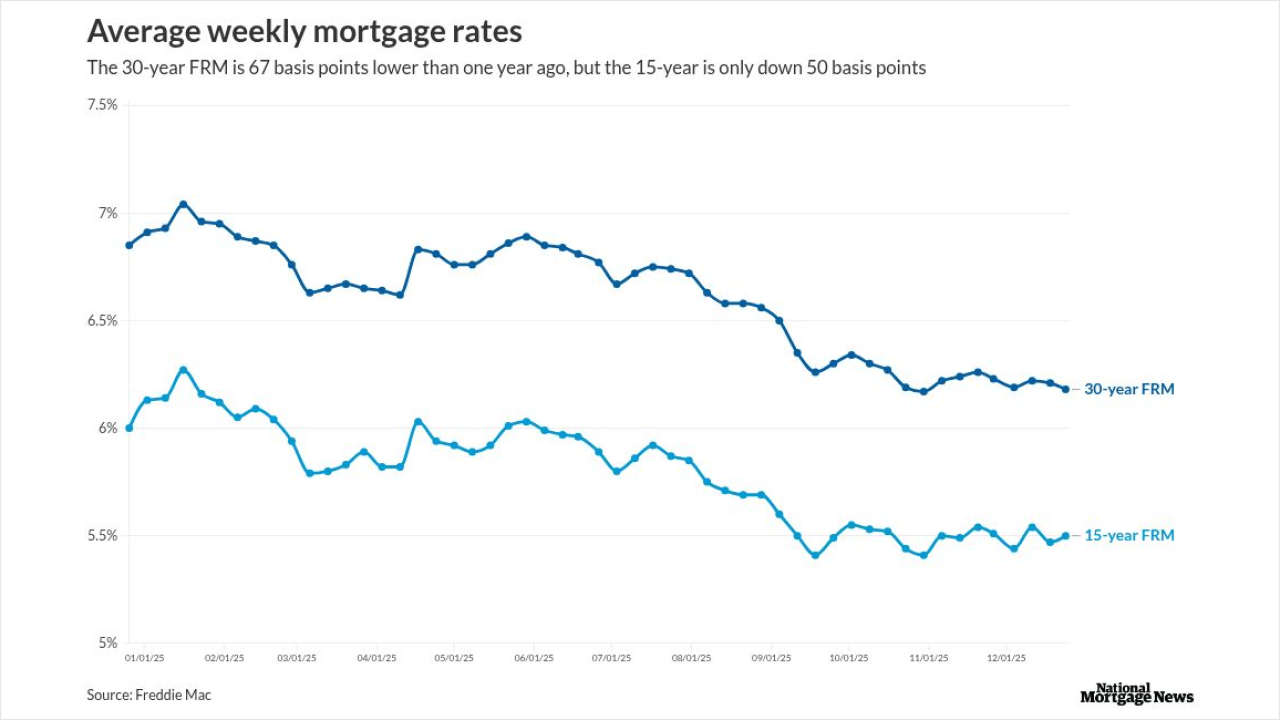

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

The Tulsa, Oklahoma-based bank expects the pace of loan growth to quicken this year, driven in part by its nine-month-old warehouse lending business.

January 27 -

The 30-year fixed rate mortgage increased 3 basis points this past week, off of a three-year low point, but are nearly a percentage point lower than a year ago.

January 22 -

Shares of Fannie Mae and Freddie Mac extended days-long losing streaks amid mounting unease about the impact of President Donald Trump's policy moves on efforts to release the mortgage-finance giants from government control.

January 16 -

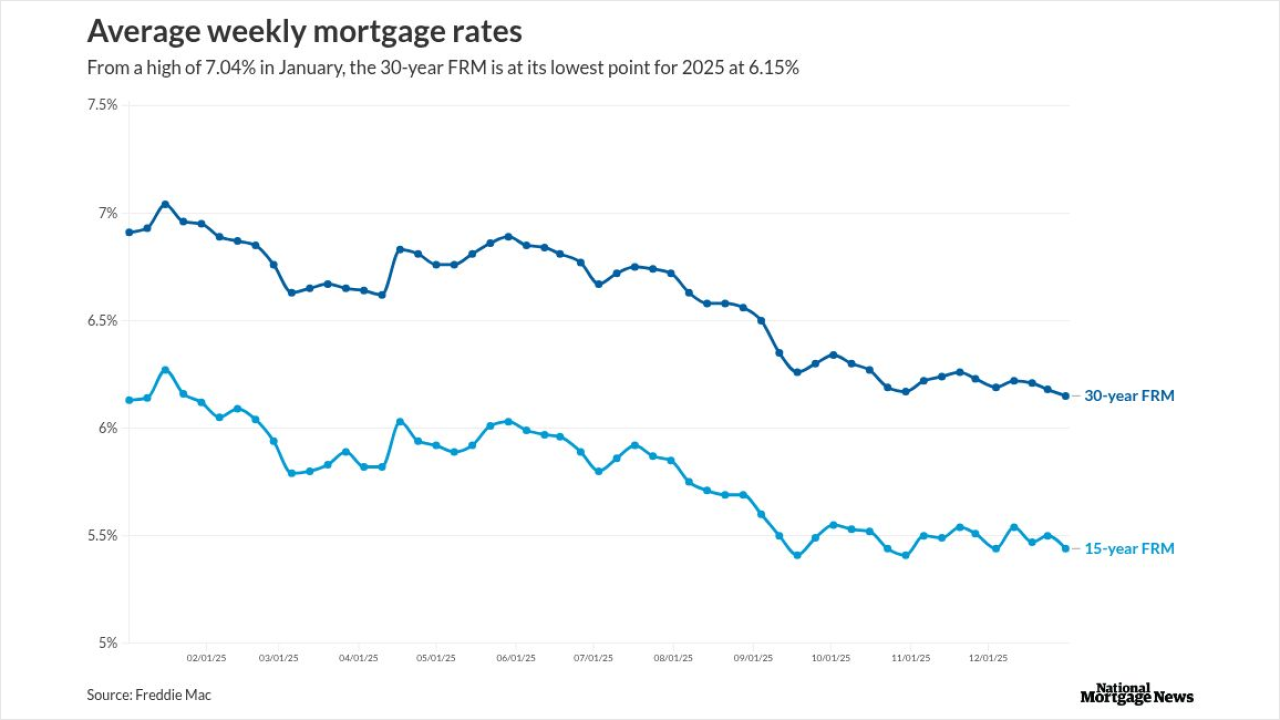

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

President Trump Tuesday told reporters he would not delay announcing his pick to fill a new vacancy on the Federal Reserve Board despite threats from Republican Senators to block any Fed nomination until a recently-disclosed Justice Department investigation into Fed Chair Jerome Powell is resolved.

January 13 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9 -

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

President Trump said he would prohibit large institutional investors from buying single-family homes. While the executive couldn't bar such investments on its own, a legislative ban could gain bipartisan support.

January 7 -

Federal Reserve Bank of Richmond President Tom Barkin said economic uncertainty should ease in the coming year as businesses gain confidence in sustained demand and adapt to the new policy environment.

January 6 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

Yields gravitated back toward session lows — down three to four basis points on the day — after the December ISM manufacturing gauge unexpectedly dropped.

January 5 -

The government-sponsored enterprise is under fire from dozens of the more than 100 workers it fired last spring for allegedly committing fraud.

January 2 -

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

Three US senators opened an inquiry into insurance ratings firm Demotech and whether its assessments may be exposing Fannie Mae and Freddie Mac to growing risks tied to climate-driven insurer failures.

December 23