Want unlimited access to top ideas and insights?

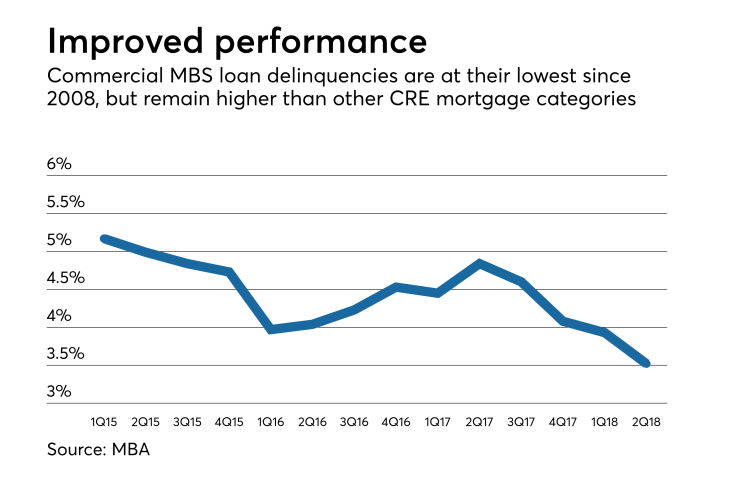

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to data compiled by the Mortgage Bankers Association.

There was a 3.52% delinquency rate for CMBS loans — defined as those 30 days or more late with their payment and REO — in the second quarter, down from 3.93% in the first quarter and 4.84% in the second quarter of 2017.

This is the lowest CMBS delinquency rate since 2008. At year-end in both 2006 and 2007, the delinquency rate for these loans was at a low point of 0.39%.

The MBA uses different sources for each investor type to compile the delinquency report, which use their own definitions to calculate the rate. There was

By investor type, only Fannie Mae had a higher delinquency rate (loans where the payments were 60 days or more late) year-over-year in the second quarter, to 0.10% from 0.04%. In the first quarter, Fannie Mae had a delinquency rate of 0.13%.

Life company mortgage investments had a 0.03% 60-day-or-more delinquency rate in the second quarter up 1 basis point from the first quarter, but down from 0.04% one year ago.

The 60-day-plus delinquency rate for Freddie Mac loans was a scant 0.01%, down 1 basis point from the first quarter and unchanged from the second quarter one year prior.

Commercial mortgage loans on bank balance sheets (which include loans secured by owner-occupied properties) had a 0.50% 90-day-or-more delinquency rate in the second quarter, the lowest since the MBA started compiling this information, Jamie Woodwell, vice president of commercial real estate research, said in a press release. This compares with 0.51% in the first quarter and 0.54% in 2017's second quarter. At the end of 2010, the delinquency rate was 4.21%.

"It is hard to overstate how low commercial and multifamily mortgage delinquency rates are today," said Woodwell. "Strong property fundamentals and values, coupled with low interest rates and ample financing options, all continue to support commercial real estate owners and their abilities to repay their mortgages."

In a separate report, the total CMBS delinquency rate should hold below 2.5% for the rest of the year as steady new issuance volume continues to push the outstanding loan balance higher and special servicers resolve or liquidate assets, a report from Morningstar Credit Ratings said.

The CMBS delinquency rate at the end of July was 2.05%, down from 2.06% in June and 3.04% in July 2017, according to Morningstar. By property type, 39% of July's delinquencies were secured by retail properties and 31% by office buildings.

The unpaid principal balance of CMBS loans in special servicing tracked by Morningstar was $20.8 billion, an increase of $224.4 million from June, and the first increase in 10 months.