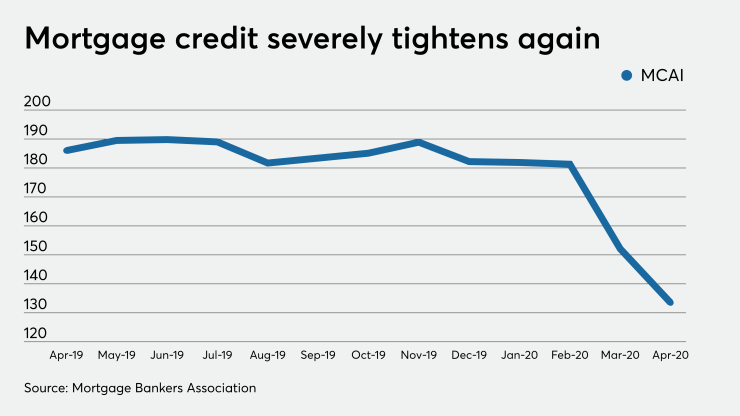

Mortgage credit availability is at its tightest in over five years as originators pull their riskier loan product types from the marketplace because of the coronavirus.

Contributing to credit clamp-up were broad-based changes in secondary market guidelines from the

The Mortgage Banker Association's Mortgage Credit Availability Index fell 12.2% to 133.5 in April from

By product segment, the conventional MCAI fell 15.2% from March, driven by a 22.6% decline in the jumbo index. The portion of the conventional MCAI that measures conforming product availability fell by 7.1%.

Meanwhile, the government MCAI, which measures Federal Housing Administration, Veterans Affairs and U.S. Department of Agriculture products, fell by 9.5. Government mortgage credit availability has tightened most months since April 2017.

The decline in credit availability "was largely driven by lenders dropping many low credit score and high [loan-to-value ratio] programs, as well as further reduction in jumbo and non-QM products," said Joel Kan, the MBA's associate vice president of economic and industry forecasting. "There was also a large decline in loan offerings pertaining to cash-out refinances, given the

The MCAI is calculated by the MBA using loan program data from Ellie Mae's AllRegs Market Clarity database. It was benchmarked to a value of 100 based on conditions in March 2012.