Organizers of a

NXG Bank — short for “next generation” — plans to establish traditional deposit-gathering and commercial lending operations around Columbia, Md. But it would also bring on a large mortgage team the day it opens.

“We’re going to try to find niches that are profitable and scale the business,” said Bill Knott, the proposed bank’s CEO. NXG aims to originate and sell agency mortgages.

NXG Bank — whose chairman would be Lori Bettinger, former director of the Troubled Asset Relief Program — intends to bring on a lending team from Mutual of Omaha Mortgage. Chris Incentino, one of the bank's organizers, oversees a 60-member team for the Mutual of Omaha unit that includes loan officers, processors and underwriters. The group is on pace to originate $400 million in mortgages this year.

The proposed bank's decision to build a nationwide mortgage platform comes at a time when other banks such as HomeStreet in Seattle and Berkshire Hills Bancorp in Boston have

NXG plans to rely heavily on technology and expertise to expand its mortgage dealings.

The proposed bank would accept applications online, though loan officers would handle approvals. NXG would get leads “from a variety of areas,” Knott said. “We’re going to do as much as we can technologically to reduce the overhead."

Incentino said originations at the bank should be evenly split between new home purchases and refinancing. That would be a shift for his team at Mutual of Omaha Mortgage, which focuses heavily on cash-out refinance.

The mortgage business will be assisted by Steve Romano, who was at Bridgeview Bank Group.

Other organizers have banking experience, including Mark Keidel, a former executive at 1st Mariner Bank who served as interim CEO from December 2011 to July 2014.

Bettinger, who was director of Tarp from 2008 to 2011, would be the chairman. She will continue to serve as executive vice president of Alliance Partners and president of BancAlliance, both in Chevy Chase, Md.

Bettinger said she agreed to join the NXG effort after being recruited by Knott and meeting a number of the other organizers.

“I feel very strongly that community banks play such an important role in the economy,” Bettinger said.

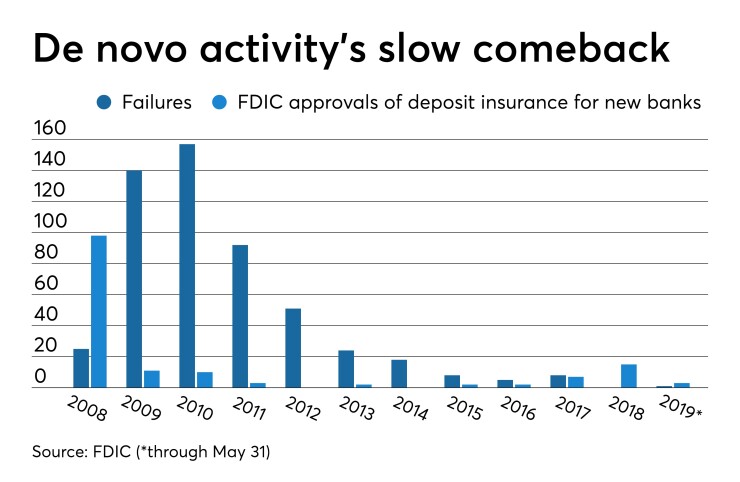

“I am so relieved to see the steady uptick in de novo applications,” she added. “It’s great to get an opportunity to see what a de novo really looks like from the ground floor. It also exciting to see community banking from another perspective and work with a dynamic organizing team.”

Given the business model, NGX plans to raise $38.5 million to $42 million in initial capital. Knott said about a quarter of the capital will come from organizers, friends and family. The goal is to open by early 2020.

Knott said his group has had a great experience working with the various regulatory agencies and with government officials in Maryland.

The application coincides with repeated efforts by Federal Deposit Insurance Corp. Chairman Jelena McWilliams to make bankers feel more comfortable applying for new charters.

“Establishing a new bank is a challenging endeavor,” McWilliams said in a

“It takes time and resources to recruit a competent leadership team, raise capital, and develop a sound business plan,” she added. “The FDIC stands ready to work with those who are prepared to build strong new community banks.”

The regulators “have been wonderful in this process,” Knott said.

“They have been instructive, candid and transparent,” he added. “They have helped us get to this point. Whatever the FDIC is doing differently [McWilliams] is doing it correctly.”