WASHINGTON — The debate over whether Fannie Mae and Freddie Mac should be allowed to keep some of their profits and rebuild capital is occurring against the backdrop of a larger, arguably more consequential battle over the U.S. debt limit.

Under the current arrangement with the Treasury Department, the government-sponsored enterprises give any profit to the U.S. government on a quarterly basis. But this quarter’s payment comes at a critical time if Congress is unable to raise the debt ceiling, raising the specter of a potential default by the U.S. for the first time in the country’s history.

“Withholding several billion dollars from the Treasury at a time when the Treasury and Congress are closing in fast on the debt ceiling would raise the political stakes dramatically,” said Jim Parrott, a former Obama White House housing adviser and owner of Falling Creek Advisors.

Treasury Secretary Steven Mnuchin has estimated that the government will be able to pay its debts until Sept. 29. The next payment from the GSEs is expected to total $5 billion and is scheduled for Sept. 30. Mnuchin has said that he expects the GSEs to continue to make dividend payments.

Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office, said the few billion dollars that Fannie and Freddie send to the Treasury isn’t usually significant in the big picture. But if Congress hasn’t raised the debt ceiling by then — a distinct possibility, given the lack of political progress on the issue to date — those payments could become hugely important.

“If you are managing staying under the limit on a day-to-day basis, $5 billion can matter a lot,” Holtz-Eakin said. “I don’t think there is any question” that the Treasury is at “the end of the road” of its spending limits, he said. “There is just not that much wiggle room.”

There is no evidence that Federal Housing Finance Agency Director Mel Watt intends to withhold the dividend payment scheduled for Sept. 30. But Watt has told Congress he is growing increasing uncomfortable with the dividend payments as the GSEs’ capital continues to deplete. Observers have suggested that the brewing fight over the debt limit could give Watt more leverage in negotiations with the Treasury over the payments.

“My sense is he will pay it at the end of the next quarter, but I also know he has been very clear in testimony that GSE reform needs to happen, and if it doesn’t happen, he may need to take some actions to protect the institutions before he leaves his job,” said David Stevens, president and CEO of the Mortgage Bankers Association.

But if Watt determines that holding onto the GSE profits is paramount, he may be able to get the Treasury to sit down at the negotiating table.

Watt will have to decide whether “the political cost of withholding the dividend is more or less than the political cost of a draw,” Parrott said.

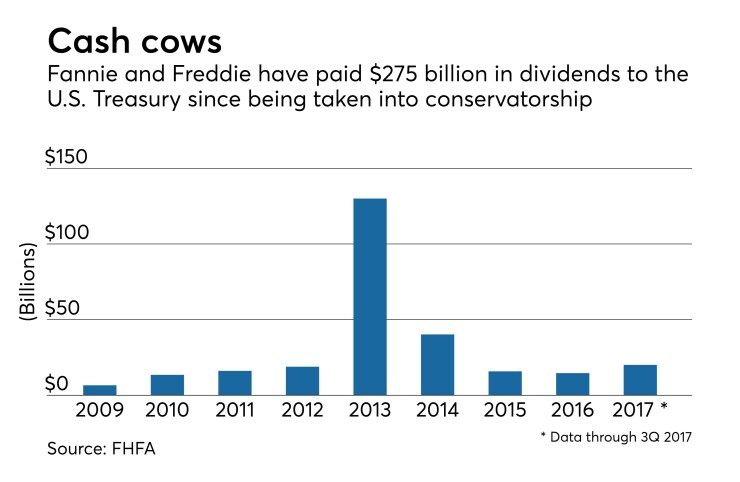

Fannie and Freddie have been sending dividends to the Treasury as part of an agreement with the FHFA that is partly designed to spur housing finance reform negotiations on Capitol Hill. The deal depletes the GSEs’ capital buffers until they reach zero in 2018, at which point they will rely on a line $258 billion line of credit from the Treasury.

Watt, who oversees the conservatorship of Fannie and Freddie, has said he would rather avoid making a draw. He fears that a draw could trigger a disruption in the mortgage market.

“In our conservatorship role, FHFA will take actions as necessary to prevent additional draws of taxpayer support,” Watt told the Senate Banking Committee in May.

Watt is also facing pressure from community banking and consumer groups that argue that he cannot wait for Congress to act.

“This strategy of trying to create instability that was put in place in 2012, maintaining the strategy makes no sense and we have continued to urge Mel Watt to change that,” said Rob Randhava, senior counsel at the Leadership Conference on Civil and Human Rights.

Ron Haynie, senior vice president of mortgage finance policy for the Independent Community Bankers of America, said, “When you start taking draws, it doesn’t get repaid, and sooner or later” the capital buffers “go to zero.”

Yet some lawmakers in Congress are fighting back, urging Watt to continue the payments. Some housing experts contend that drawing on the Treasury would be a nonevent.

“Given the modest size of any draws in the current healthy economic environment, and the Treasury’s enormous commitment, this does not pose an economic risk over the near term,” said Parrott. “It would not become an economic issue until the draws begin to add up over time, or we see much larger draws arising from another rough patch in the market.”

Lawmakers have already sent a warning letter to Watt not to change the arrangement, fearing that doing so would hurt the chances for housing finance reform.

But there is growing speculation the Treasury will work out a deal with the FHFA.

“If there is deal cut, we hear that there may be some sort of a wink and nod that maybe the Treasury department is going to let the director allow the GSEs to keep some of the money and build up this cushion,” said Jerry Howard, CEO of the National Association of Home Builders. “If that is the case, it will be contrary to congressional intent, and I can’t imagine it will sit well with” Senate Banking Committee Chairman Mike Crapo. “And I am positive," Howard added, that "it won’t sit well with” Housing Financial Services Committee Chairman Jeb Hensarling, “and I think there will be ramifications.”

During the Senate hearing in May, Watt said the quarterly dividends make Fannie and Freddie more susceptible to short-term fluctuations and could be impacted by a one-time event like tax reform, which could devalue the GSEs’ tax deferred assets and force them to take a draw on the Treasury. He added that minor alterations could be made by adjusting the current dividend sweep arrangement.

“I think the appropriate conversations about those options really need to take place between us and the secretary of Treasury,” Watt said.

Some observers believe that the dividend could be switched to an annual payment.

“I have been hearing a lot more chatter” that the FHFA will “switch to an annual determination rather than withhold dividends,” said one industry insider, who wanted to remain anonymous because of the sensitivity of the issue. “It could very well be that what happens is that Watt and the Treasury secretary strike a deal where he starts that with the third-quarter payment rather than this payment right up against this debt ceiling discussion.”

But amending the sweep arrangement could complicate a lawsuit with hedge fund investors who are suing over the legality of the 2012 arrangement. It would also still leave Fannie and Freddie without any capital at the end of 2018 unless another arrangement was made.

Stevens cited the lawsuit as a reason Watt should continue delivering the payments.

“He should not send a signal to the market that recap and release is a possibility, because that would be a windfall for Wall Street investors,” Stevens said.

He added that on top of the debt ceiling, Mnuchin is negotiating a budget deal, which also benefits from the GSE payments.

“I don’t believe the administration is going to come to an agreement with Director Watt on anything of that nature," Stevens said, "especially when Mnuchin has a debt ceiling to deal with and a budget that has a lot of funding needs.”