Mortgage delinquencies in areas affected by Hurricane Harvey last month were 16% higher than in July, according to Black Knight Financial Services.

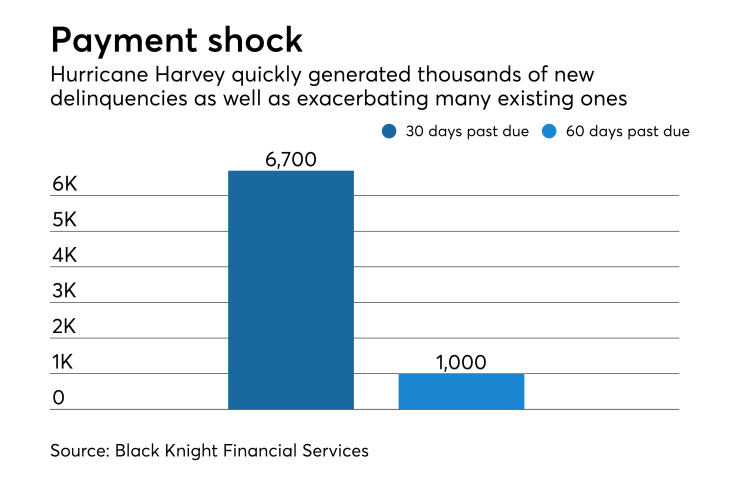

More than 6,700 new 30-day delinquencies stem from the hurricane and 1,000 borrowers already 30 days past due missed another payment, said Black Knight.

Despite the spike in Harvey-related delinquencies, nationally on loans not yet in foreclosure they were flat compared with July, rising only 0.72% to 3.93%, and compared with a year ago the rate is 7.27% lower than it was last August.

Texas is now among the five states that have seen the most deterioration in their noncurrent loan percentages over the last six months, although states like South Dakota, Nebraska and North Dakota have seen more deterioration than Texas.

Delinquencies related to a natural disaster historically peak in the first few months and late payments for September could be more pronounced as Harvey and other hurricanes affect loans. More than a quarter of properties in Harvey-affected areas could be delinquent within four months after the storm,

More than 2 million loans had delinquencies of 30 or more days but were not in foreclosure last month. That total was up 17,000 from July and down 148,000 from August a year ago.

When foreclosures are added to the delinquent-loan total for August, it rises to almost 2.4 million.

Prepayments also were more frequent in August compared to July but slower than they were during the same month in 2016. The monthly prepayment rate was 1.13%, which was 11.47% faster than the previous month by 32.33%, but 32.23% slower than in August 2016.