The percentage of mortgages late by 30 days or more but not in foreclosure dropped to 4% last month, marking a low not seen since March 2020, according to Black Knight.

The drop from 4.4% in July and 6.88% a year ago is notable in that it brings the total delinquency rate much closer to a pre-pandemic norm that’s

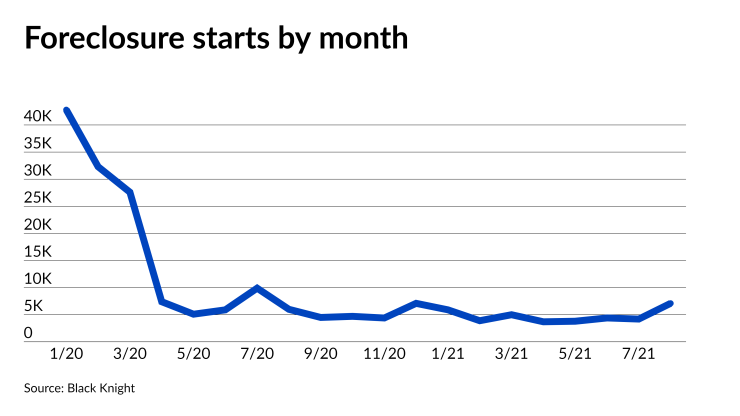

Black Knight on Wednesday also recorded a modest uptick in foreclosure starts somewhat similar to that seen in

While the extent to which various loan performance indicators have gotten back to normal varies, the majority of them seem to be moving in the right direction.

For example, buyouts of distressed loans from securitized pools Ginnie insures are subsiding, noted Scott Buchta, senior managing director and head of fixed income strategy at Brean Capital, in a recent Ginnnie Mae capital markets podcast.

What happens next in mortgage performance trends depends largely on the next actions taken by borrowers whose pandemic-related payment suspensions expire in the next couple of months.

“The majority of borrowers who have missed at least 18 months of payments will need some kind of loan modification in order to get on track,” Buchta said.