Ditech Holding Corp. fired its chief operating officer after nine months, and entered into a forbearance agreement for a debt payment that was due in December, it said in a regulatory filing.

The company, which started with a clean slate after

The possibility of

Ritesh Chaturbedi joined Ditech as COO

He started at Ditech on April 23, 2018 and his last day was Jan. 11, according to the Jan. 17 filing, which included a copy of the

On Dec. 17, Ditech was supposed to make a $9 million interest payment to the holders of its 9% Second Lien Senior Subordinated PIK Toggle Notes due 2024. Failure to make that payment triggered a 30-day grace period, which expired on Jan. 16.

The company had sufficient liquidity on both dates to make the payment, the regulatory filing said. "As active discussions are still ongoing regarding the company's evaluation of strategic alternatives, the board determined that the company would not make the interest payment prior to the expiration of the 30-day grace period," the filing said.

The nonpayment not only constituted a default of this debt offering, but also a default to the lenders under the Second Amended and Restated Credit Agreement and to its warehouse lenders. All three creditor groups agreed to a forbearance that expires on Feb. 8.

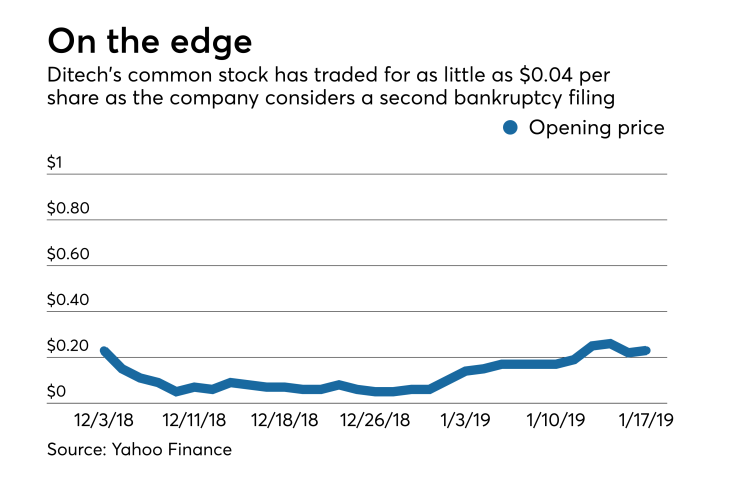

Ditech trades on the pink sheets. After the filing, its common stock price dropped by over 24% to $0.19 per share during the afternoon of Jan. 17.