Want unlimited access to top ideas and insights?

Harnessing the power of DU to provide you with Day 1 Certainty™

Desktop Underwriter® (DU®), the most widely used automated underwriting system in the market today, now gives you even more power with the DU validation service. Fannie Mae’s DU validation service is designed to provide lenders with enhanced loan origination controls, process efficiency, and certainty around borrower income, assets, and employment input into DU.

How the DU validation service works

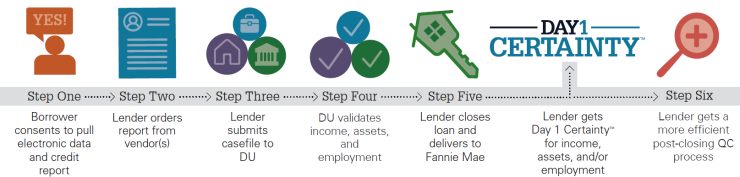

When a lender opts in to use the DU validation service, DU will use third-party vendor data to perform calculations and validate information entered by the lender in DU.

With borrower consent, the lender orders an eligible verification report from a DU validation service vendor. The lender reviews the report, addresses any discrepancies with the borrower, enters the information into DU, and submits the loan.

DU obtains a duplicate copy of the report from the vendor and performs its own income and asset calculations to arrive at a value that is compared to DU. DU issues messages advising the lender on whether the income, assets, and/or employment could be validated, as well as the documentation required.

As long as the lender meets all DU validation service requirements and complies with applicable DU messages, the lender receives Day 1 Certainty for validated components.

DU validation service benefits

- Easier Documentation Process. Borrowers save time by consenting to use electronic data versus collecting documents such as paystubs, bank statements, and investment account statements.

- Streamlined Loan Processing. Keeps lenders focused on exceptions.

- Dynamic Underwriting. Validates key loan data up front, provides more certainty on income and asset calculations, and confirms that the validated component meets Fannie Mae’s requirements.

- Process Efficiencies. Reverification is not required for assets, income, and/or employment validated in DU; execution of the IRS Form 4506-T is not required when all borrower income has been validated; and lenders have lower fraud risk when data is gathered from the source.

- Day 1 Certainty. Lender receives certainty regarding income, assets, and employment information validated by DU. With validation, lenders will receive freedom from representations and warranties with regard to the accuracy of income and/or asset calculation, borrower employment status, and the integrity of the data from the vendor.

Steps to sign up for the DU validation service

- Learn more about the DU validation service.

- Talk to your Fannie Mae account team

- Review learning materials posted on the

DU validation service web page DU Release Notes - Review policy changes in the

DU Validation Service Reference Guide. You will need DU/DO or Fannie Mae Connect user credentials to access the reference guide. FAQs - View DU validation service eLearning presentation

- Engage with DU validation service vendors* – execute contracts and complete activation process. The DU validation service uses third-party data reports to independently validate borrower income, assets, and employment data. Review the

data vendor list . - Submit Fannie Mae

DU Validation Service Set-Up form . Allow 3 – 6 business days for activation; a confirmation email will be sent when the request is processed.

Note: Users of Desktop Originator® (DO®) on the Web complete the

Please complete activation with the vendor PRIOR to submitting the DU Validation Service Set-Up form. Activating with Fannie Mae prior to activating with a vendor will result in irrelevant DU validation messages on all loan casefiles submitted to DU.

*Data Vendor Information

Fannie Mae has an open platform for data vendor participation to provide a range of options for our customers.

Lenders may participate in the DU validation service through relationships with vendors of their choice that can provide Day 1 Certainty verification reports accepted by Fannie Mae. More information on Fannie Mae’s open platform for data vendor participation is available in the

View the

Learn more

For more information, contact your account team or call 1-800-2FANNIE (1-800-232-6643), Option 1 (technology support).

Information is also available at

© 2017 Fannie Mae. Trademarks of Fannie Mae.