Prepayment rates for 30-year Fannie Mae and Freddie Mac mortgage-backed securities rose slightly in May, spurred by seasonal increases in turnover in the face of mixed refinancing activity, according to Bear Stearns.Fannie Mae 30-year MBS speeds increased from a constant prepayment rate of 18.7 CPR to 19.2 CPR overall, while comparable Freddie Mac speeds remained nearly unchanged, said Bear Stearns analyst Dale Westhoff. Meanwhile, Ginnie Maes saw "larger, more consistent" speed-ups across the coupon stack, resulting in a widening of the Ginnie Mae-conventional prepayment gap, he reported. Mr. Westhoff noted that the conforming 30-year mortgage rate had dropped more than 40 basis points from its recent peak of 6.10% in April. "This has increased the proportion of fixed-rate borrowers facing refinancing opportunities of 40 bps or more from just 21% at the beginning of April to roughly 34% at the current 30-year mortgage rate of 5.68%," he said/ The increase in refi opportunities "should boost June prepayments by roughly 10%-15%," Mr. Westhoff said. Bear Stearns can be found online at http://www.bearstearns.com.

-

The company also revealed more about the impacts of its data breach, and said it doesn't consider the development likely to materially affect its results.

2h ago -

The fourth quarter results integrated the operations of both Redfin and Mr. Cooper into Rocket Cos., with the deals likely contributing to the full year loss.

6h ago -

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

7h ago -

Rocket Mortgage and Compass launched a three-year Redfin listing partnership, expanding access to 500,000+ homes, with executives saying they see no RESPA compliance issues.

7h ago -

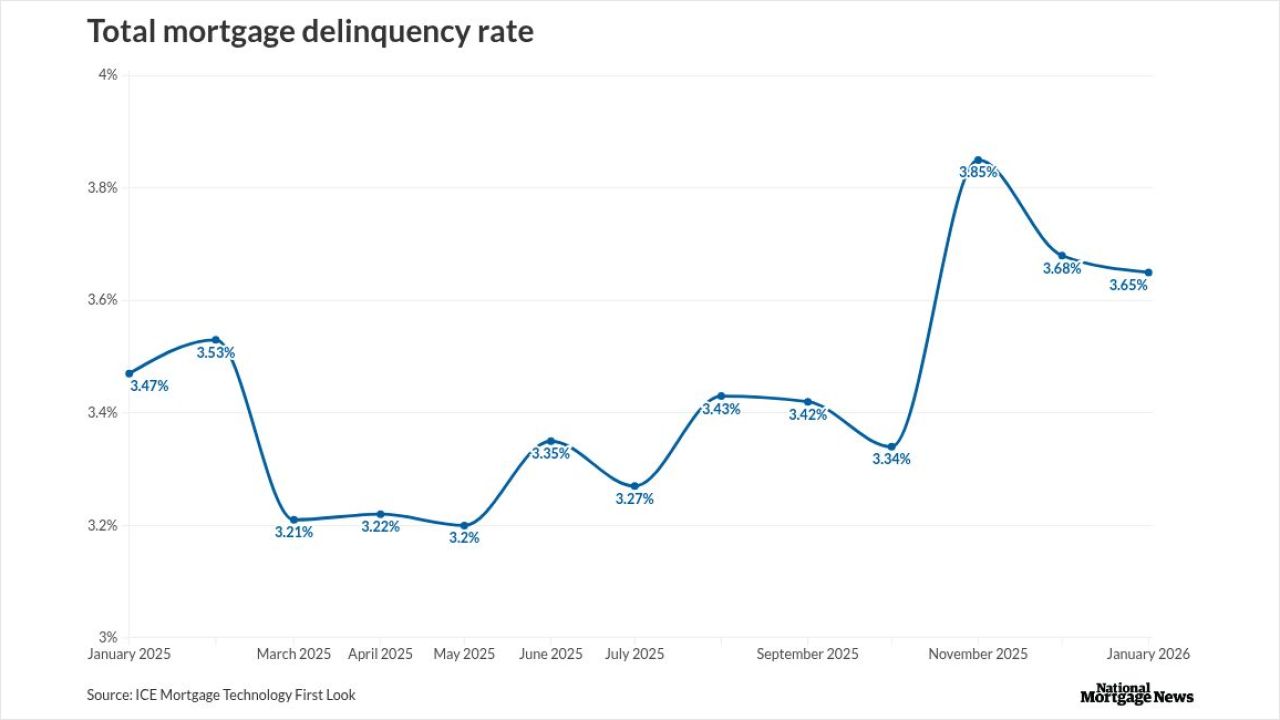

While overall delinquencies eased in January, foreclosure starts jumped to their highest point since early 2020, signaling growing strain among late-stage borrowers despite steady mortgage performance.

8h ago -

Senate Majority Leader John Thune, R-S.D., moved to consider the housing package next week, but it's not clear what version of the bill senators will be voting on as the House, Senate and White House are still negotiating priorities.

10h ago