Overall, the serious delinquency rate for conventional mortgages in Fannie Mae’s single-family portfolio fell to 1.01% in March, bringing it closer to pre-pandemic levels, but remaining above a key threshold.

That rate was down from 1.11% the previous month, the pandemic peak of 3.32% (August 2020) and 2.58% a year ago, but it remains above the psychologically important 1% mark, and the base level of 0.66% it was at going into the pandemic.

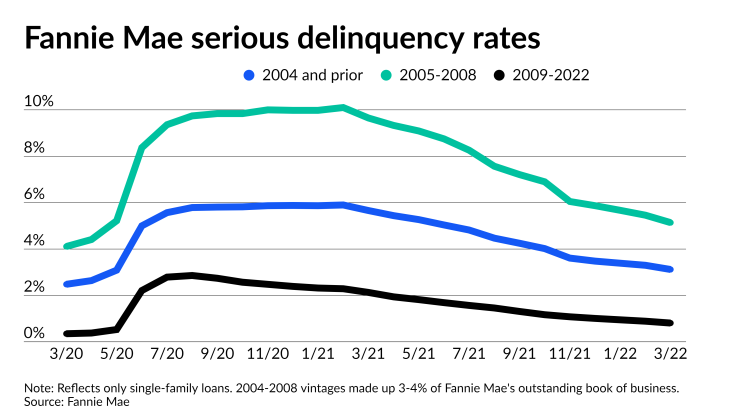

However, a closer look at the numbers reaffirms other findings in the broader market that suggest when the serious delinquencies from older mortgages originated before 2009 are removed, loan performance looks stronger.

For newer conventional, single-family mortgages in Fannie’s portfolio, serious delinquencies in March fell to 0.81%, down from 0.89% the previous month and 2.86% when the pandemic peaked in August 2020. A year ago, the serious delinquency rate in this category was 2.13%.

The older loans, which constituted around 4% of Fannie’s portfolio in 2021 and 3% this year, increased that number for the overall portfolio. While the percentage of these loans in Fannie’s book of business is low, their outsized influence on the overall serious-delinquency rate suggests they may have a relatively higher concentration within the universe of mortgages with particularly deep distress, in line with

Exceptionally loose underwriting at origination and the collapse of

Mortgages originated in 2004 or earlier made up 1% of Fannie’s book of business in March. Their serious delinquency rate was 3.12% in March, down from 3.3% the previous month, 5.66% a year earlier and 5.9% at their pandemic peak, which for this group was February 2021. At the start of the pandemic, these loans had a 2.48% delinquency rate.

As their decline in the portfolio share to 1% from 2% in the past year demonstrates, eventually these older loans will run off and not be a factor in Fannie’s book of business. However, some distressed loans from this era have been particularly slow to leave the books because some states have exceptionally long pipelines of loans going through foreclosure due to heavy regulation and court-based processes.

Although currently serious delinquencies appear to be concentrated in older loans, Fannie has warned that newer borrowers could experience some mild distress as well in the coming year. Its economists are