Fannie Mae's latest 2021 mortgage origination forecast now calls for a 1% year-over-year increase in total production, as the company raised both its purchase and refinance expectations from the

Recent home price gains should moderate over the coming quarters as the temporary factors influencing them wane. But Fannie Mae’s economists also believe inflation will remain significantly above the Federal Reserve's 2% target through 2023, which could affect interest rates.

Though economic growth is slowing with inflation and supply chain issues, it's not dragging at a pace that makes interest rates react rashly, so housing and mortgage activity remains strong.

"Market participants will have one eye on the monthly inflation releases and the other eye on the Fed in the months ahead," Fannie Mae Chief Economist Doug Duncan said in a press release. "How credible investors, business leaders, and consumers find the Federal Reserve's evolving beliefs regarding the passing or sustained level of inflation and resulting monetary policy actions will be key — their choices will impact economic growth as well as housing and mortgage activity."

The government-sponsored enterprise now expects over $4.4 trillion in total activity this year, compared with $4.37 trillion in 2020; in October, Fannie forecast $4.32 trillion for 2021. In its most recent quarterly forecast issued in October, Freddie Mac predicted 2021 originations will top 2020's.

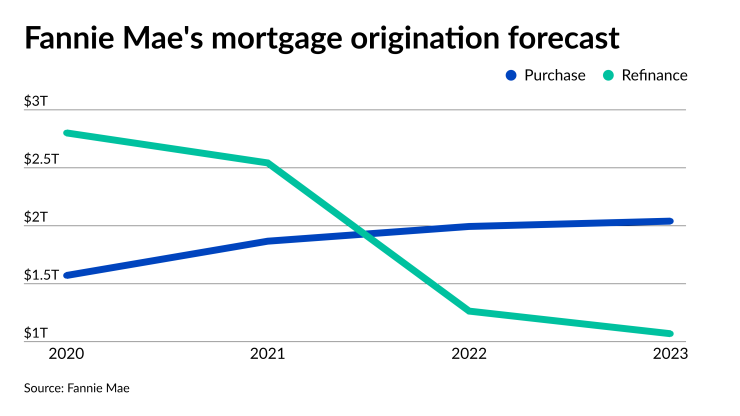

The November analysis states purchases will total $1.87 trillion of 2021 volume, with refinancings adding another $2.54 trillion. This compares with its October forecast of $1.85 trillion purchase and $2.47 trillion refi.

Home sales in 2021 are now predicted to run at a seasonally adjusted annualized rate of 6.8 million units, compared with 6.74 million units a month ago. This was a result of

However, Fannie Mae cut its 2022 forecast to $3.26 trillion from $3.33 trillion a month ago, assuming rising rates and the continuing inventory shortage will affect purchase activity.

The November outlook predicts just under $2 trillion in purchase originations and $1.27 trillion in refis; one month ago, Fannie forecast $2.01 trillion of purchase volume with refis coming in at $1.32 trillion.

Fannie provided its first outlook for 2023, with year-to-year production expected to decline by almost 5% to $3.11 trillion. Purchase volume is predicted to increase slightly in 2023 to $2.04 trillion, while refis slip to $1.07 trillion.

The Mortgage Bankers Association's

Mortgage rates should average 3.3% in 2022 and 3.5% in 2023, according to Fannie Mae. "The risk, however, is that if longer-run inflation expectations start rising meaningfully, then rates could move decidedly higher," an accompanying report said. "Alternatively, if higher inflation prompts a more aggressive Fed tightening going forward and this is seen as risking another recession, long rates could start falling again, inverting the yield curve."