MGIC Investment Corp.'s quarterly earnings were again driven by better-than-expected loss development, and those favorable results should be seen in the other private mortgage insurers' results as well, an industry analyst said.

For the third quarter out of the last four, the company had a negative loss ratio (a lower number is better) of 0.6%. In

MGIC's net income of $180.9 million, or $0.48 per share, beat the consensus and B. Riley FBR's estimates of $0.36 and Keefe, Bruyette & Woods' estimate of $0.34 per share.

For

The mortgage insurer was expected to have a 15% loss ratio for the quarter by B. Riley FBR analyst Randy Binner.

"Overall, we view this as a favorable result for MGIC and expect this trend to continue to the other PMIs," Binner said in a research note.

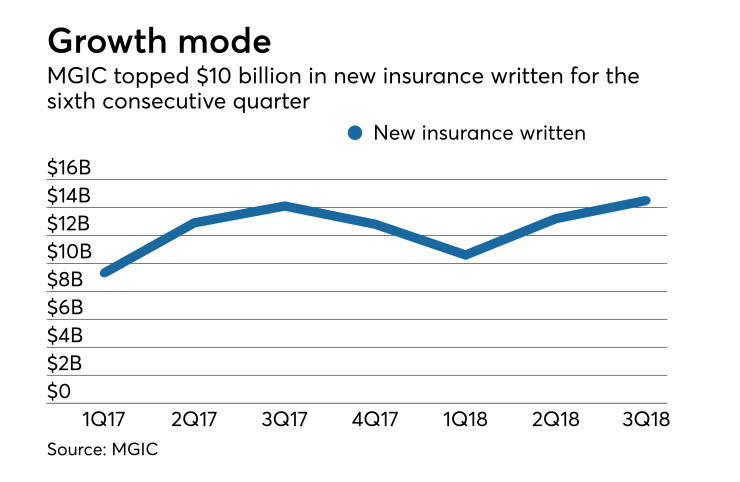

New insurance written for the quarter totaled $14.5 billion, up slightly from $14.1 billion one year ago.

Incurred losses during the quarter were negative $1.5 million, compared with $29.7 million in the third quarter last year.

It reported 13,569 new delinquency notices received during the quarter, compared with 12,159 in the second quarter and 15,950 one year ago.

The delinquent loan inventory ended the quarter at 33,398, down from 41,235 on Sept. 30, 2017.

"The current operating environment enables us to report another quarter of strong earnings," said MGIC CEO Patrick Sinks in a press release. "MGIC is, and expects to remain, in a strong capital position following the finalization of the revised PMIERs financial requirements and paid a $60 million dividend to the holding company in the third quarter."

The upstreamed dividend was $10 million higher than in the previous quarter, and came even after MGIC disclosed that the revised

However, MGIC is planning to raise capital through a $318.6 million insurance-linked notes offering that should close at the end of this month, the company said in a Securities and Exchange Commission filing made on Oct. 16, the day before the third-quarter results were released.

Mortgage origination volume

"While a robust mortgage origination and housing start environment would be ideal, the key factors affecting mortgage credit quality are home price appreciation and employment," Binner said. "We expect these trends to persist and thus we do not see higher interest rates affecting our view of forward earnings per share for mortgage insurers. We expect losses among the MIs to remain low, supporting EPS."