Only a small percentage of borrowers are deterred by the higher rates seen this year, even with the additional cost making it tough for first-time buyers to find affordable properties.

"Combining even slightly higher rates with price growth this strong will make it even more challenging for first-time buyers to find affordable homes to buy this year. The good news for sellers is modest rate increases are unlikely to curtail buyer demand," said Redfin Chief Economist Nela Richardson in a press release.

"Just 6% of respondents to a survey commissioned by Redfin said they would cancel their home buying plans if rates rose above 5%," she said.

Mortgage rates in February reached the highest levels seen in nearly three years as home prices increased by their fastest pace since March 2014, according to Richardson.

"A growing economy, healthy buyer demand and low inventory drove the ramp up in prices last month," she said.

Housing prices rose 8.8% year-over-year to a median of $285,700 in the markets Redfin serves in February, marking 72 consecutive months of year-over-year price increases.

Over 21% of the homes sold last month were purchased for more than the list price, up from 19.6% one year prior.

Although

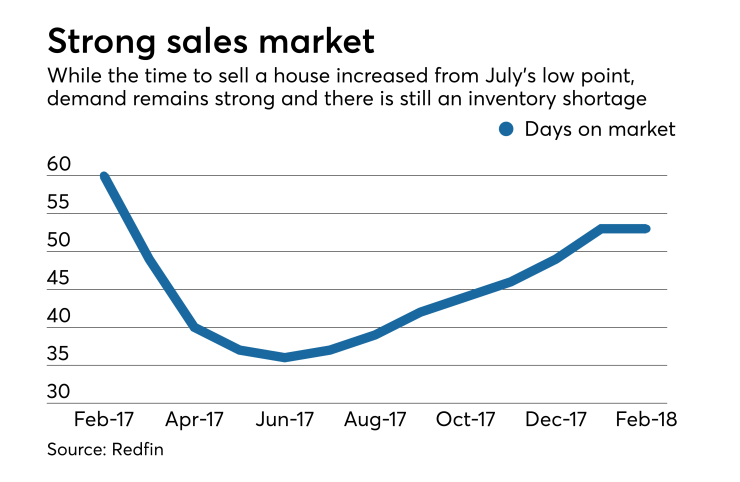

The median number of days a home was on the market from listing to sale was unchanged from January at 53. A year ago, it took about 60 days to get a home off the market, but during warmer months in 2017 houses sold in less than 40 days.

Redfin estimated there was a 3.7 month supply of homes for sale at the end of February this year, up 0.2 months from January but down 0.4 months from a year ago.