The share of severely underwater mortgages shrunk by over two percentage points compared with a year ago, as these borrowers benefited from the rise in equity levels, Attom Data Solutions said.

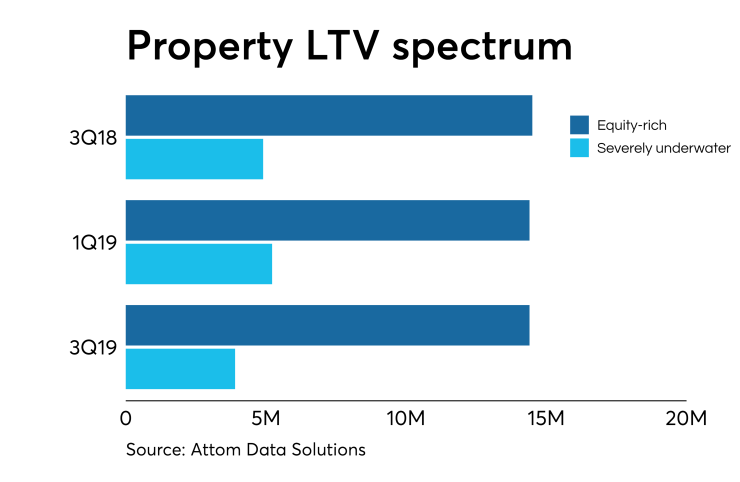

About 3.5 million homes had a combined loan-to-value ratio of 125% or more, equal to 6.5% of all mortgaged properties. That dropped from 4.9 million seriously underwater properties or 8.8% of homes with a mortgage, in the third quarter of 2018.

In the

But increasing home values did not have the same effect on the upper end of the spectrum. The number of equity-rich mortgaged homes — CLTVs of 50% or less — totaled 14.4 million for the third quarter, compared with 14.5 million one year prior.

The share rose one percentage point to 26.7% from 25.7%.

"The latest numbers reveal another profound impact of the extended housing boom, as far more homeowners find themselves on the right side of the balance sheet instead of the wrong side," Todd Teta, Attom's chief product officer, said in a press release. "This is a complete turnabout from what was happening when the housing market crashed during the Great Recession.

"There are notable equity gaps between regions and market segments. But as

The top 10 seriously underwater states in the third quarter were all in the South and Midwest. Louisiana topped that list, with 16.5% of mortgaged properties seriously underwater). Others in the top five were Mississippi (15.8%), West Virginia (14.2%), Iowa (14%) and Arkansas (13.1%).

Among the 107 metropolitan statistical areas with a population greater than 500,000, Youngstown, Ohio, had the largest share of seriously underwater mortgages (16.8%). It was followed by Baton Rouge, La. (15.7%), Scranton, Pa. (14.3%), Cleveland (14%) and Toledo, Ohio (13.8%).