The Federal Housing Administration has proposed a rule that would allow borrowers to obtain private flood insurance policies on mortgages the FHA insures.

"Our proposal would expand the options for obtaining flood insurance, rather than continuing to lock in borrowers to one federal option without any ability to comparison shop," Federal Housing Commissioner Dana Wade said in a press release.

"We are also proposing important safeguards that will help protect borrowers, so their homes will have flood insurance coverage at a level at or above the level available through the National Flood Insurance Program," she stated.

Currently, FHA-insured mortgages secured by properties in special flood hazard areas must have NFIP policies.

The Biggert-Waters Reform Act of 2012 required the acceptance of private flood insurance policies by the government-sponsored enterprises as well as the government agencies. However, the GSEs required the private insurance terms and amount of coverage to be at least equal to that provided under an NFIP policy on any mortgage they purchase. That has had an impact on insurers

Last year, federal banking regulators

"This proposal will remove yet another unnecessary regulatory barrier to doing business with FHA and can also reduce costs to the federal government," added Joe Gormley, deputy assistant secretary for single-family housing. "Allowing participation by private insurers should generate the competition needed to ultimately reduce costs for consumers."

The FHA's proposed rule also notes the ongoing problems with renewing the NFIP, commenting that a private option "may reduce the likelihood of delays in the processing of new originations" if

Between 3% and 5% of FHA borrowers could obtain a private flood insurance policy if this option becomes available, the agency said.

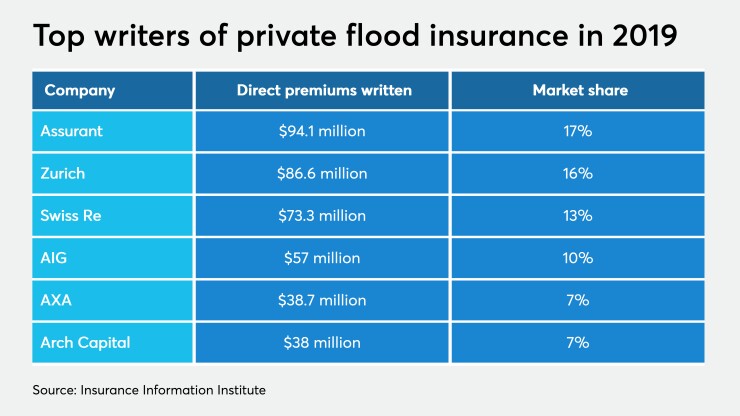

In 2019, $522.6 million in direct premiums were written by 41 private flood insurers, compared with $360.1 million from 32 companies the prior year, according to the Insurance Information Institute.

However, this data does not include policies written by FM Global, which in 2019 reclassified its private flood insurance into allied lines. In 2018, FM Global had $300 million in direct premiums written or a 43% market share.

The top underwriter in 2019 was Assurant, with $94 million in premiums written for a 17% market share. Arch Capital Group, which also writes private mortgage insurance, ranked sixth in 2019, with $38 million in direct premiums written.

Interested parties will have 60 days to comment on the FHA's proposed private flood insurance rule once it is published in the Federal Register. The administration is also seeking public comment on a proposal to create a compliance aid for lenders, which would determine if a private flood insurance policy meets the agency's requirements.