BlackRock Inc., Highfields Capital Management, and a management team led by a former Countrywide executive have announced the formation of a company that will acquire and restructure distressed residential mortgage loans. Private National Mortgage Acceptance Co. LLC, or PennyMac, has been formed in Calabasas, Calif., by the two firms and a group of industry veterans led by Stanford L. Kurland, a former president of Countrywide Home Loans. "Our intent is to combine fresh capital with deep mortgage portfolio management and servicing expertise," said Mr. Kurland, chairman and chief executive officer of PennyMac. The companies can be found on the Web at http://www.blackrock.com, http://www.highfieldscapital.com, and http://www.pnmac.com.

-

The announcement drove a large increase in Better's stock price, but UWM, Rocket and Pennymac all saw any gains earlier in the day more than dissipate.

1h ago -

Many homeowners and first-time buyers are surprised by rising property taxes and insurance, which can sharply increase monthly mortgage costs beyond principal and interest.

2h ago -

Median rents rose at a greater rate than median sales prices in 55% of the 416 counties with sufficient data between 2025 and 2026, Attom found.

2h ago -

While this only shows a 2-basis-point rise in the 30-year fixed since last week, the Lender Price product and pricing engine data is 30 basis points higher.

6h ago -

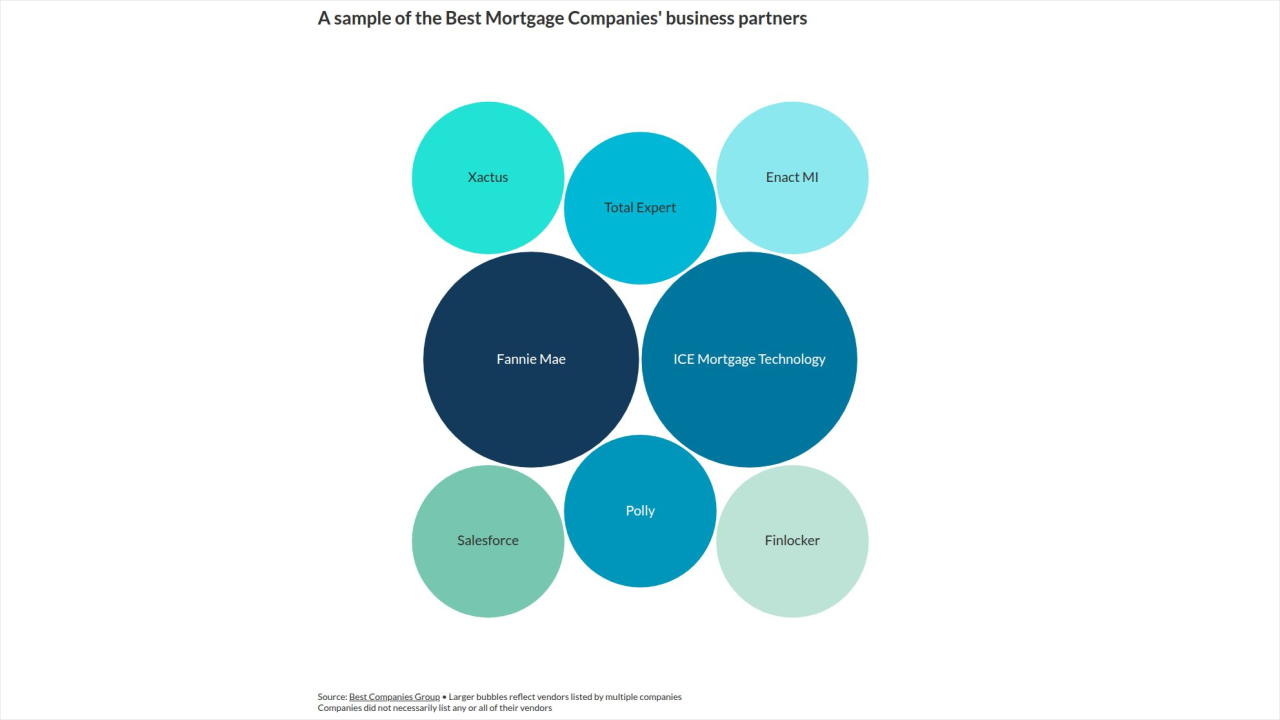

The top employers in home lending value business partners with a large market share and reach but they also need to differentiate themselves.

8h ago -

Lendwise filed a complaint against Priority Financial Network, claiming it falsely reported to partners that Lendwise organized an "Amended Returns Scheme."

9h ago