-

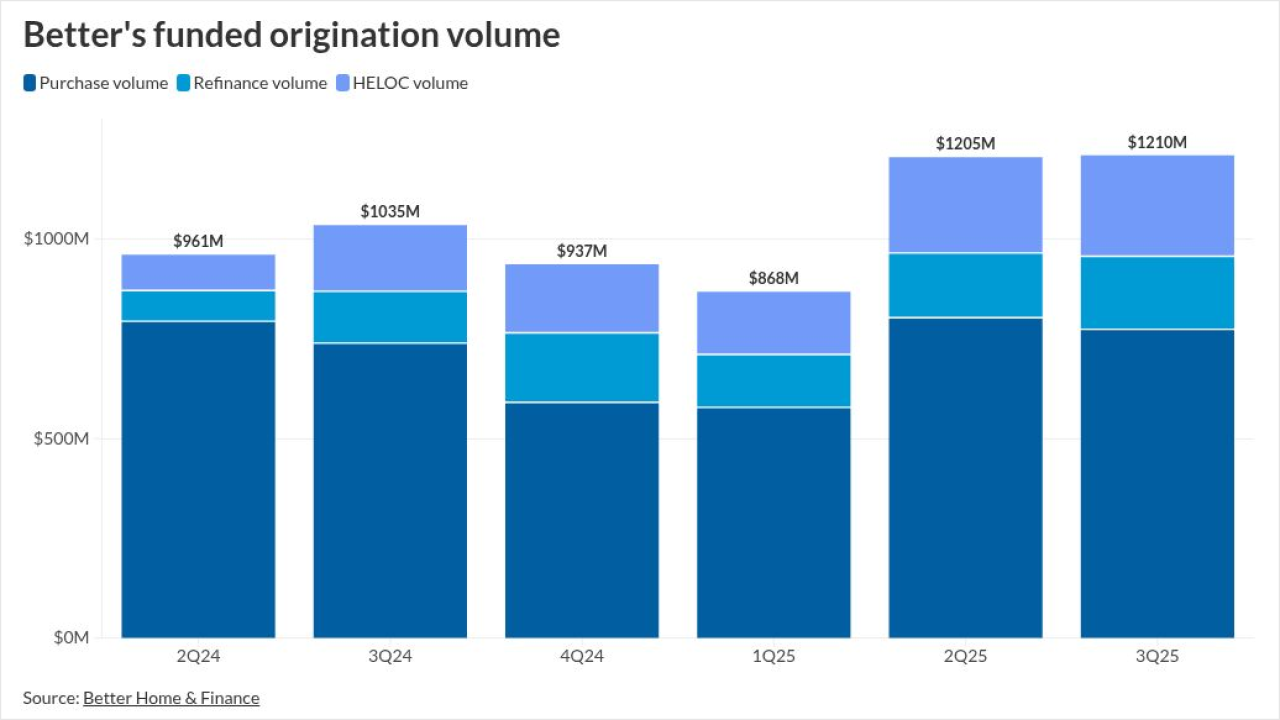

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

The lender, which reported over $200 million in home equity line of credit volume in the recent quarter, suggests the business can deliver massive scale.

October 21 -

The largely direct-to-consumer lender will also offer reverse mortgage loans in the latest dealing between publicly traded industry players.

October 14 -

The retail business in its hiring announcement touted its technology offerings and transparent compensation structure in attracting the originators.

September 4 -

The company, which is projecting adjusted EBITDA profit next fall, saw its Neo Home Loans arm more than double its production from the first quarter.

August 7 -

Notable changes in executive compensation at public IMBs heavily relied on stock awards received that year.

June 13 -

The company is positioning its Tinman platform as a serious industry competitor and suggests it's eying product costs of around $1,500 per loan.

May 13 -

Small-business owners will be given the option to tap into anywhere from $50,000 to $500,000 in financing.

April 24 -

The re-engineering of the convertible note arrangement between the two parties includes a one-time cash payment of $110 million by Better.

April 14 -

The lender says its technology will supercharge scale, preventing a potential hiring and firing spree which doomed it after the recent refinance boom.

March 19 -

Better touted the company's efficient operations, including an artificial intelligence voice assistant handling all of its inbound customer calls.

November 13 -

Better's voice assistant can help customers get answers to mortgage application inquiries, call them back if they abandon an application and ask them about the weather.

October 17 -

The publicly traded firm is also shoring up its sluggish stock and ramping up marketing efforts.

August 8 -

The digital lender increased its marketing spend in the first quarter of 2024, with the ultimate goal of "Uber-izing the loan officer."

May 14 -

The digital lender also agreed with a former executive to drop her lawsuit accusing the company of misleading investors.

May 13 -

The digital lender disclosed a prolonged low stock price could have forced it to redeem a $528 million convertible note from sponsor SoftBank.

April 10 -

The lender recorded a $59 million net loss in the fourth quarter, an 83% improvement from its third quarter performance.

March 28 -

The lender has shed over $1 billion in annualized expenses and said it retains enough capital to sustain operations for the next several years.

November 14 -

The firm says the product can save companies in excess of 30% of their existing cost structure.

November 9 -

The digital lender's product comes amid soaring expenses for homeowner's coverage.

November 2