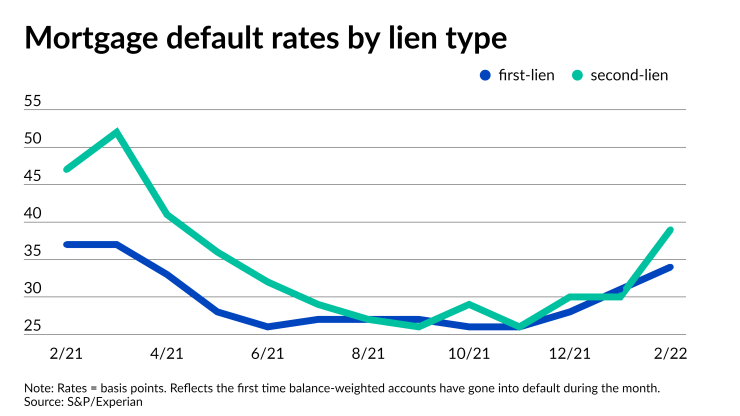

In February, the number of primary mortgages that went into default for the first time rose at the highest rate seen in nearly a year, according to Standard & Poor’s Dow Jones Indices and Experian.

The balance-weighted first-mortgage default rate increased to 0.34% from 0.31%

The second-mortgage default rate rose even more, to 0.39% in February compared to 0.30% the previous month, following an unusual period in which it actually dipped below the first-lien rate multiple times. The second-lien default rate was last this high in April 2021, when it was 0.41%.

The increase in the first-mortgage default rate in concert with a more pronounced rise in the number for second liens bears out other indications that loan performance is

The composite default rate for various types of consumer credit also rose to its highest point since April 2021 in the past month. This rate, which also reflects auto loan and bankcard activity, rose to 0.46% from 0.43% in January. In April of last year, it was 0.50%.

The default rate for auto loans dropped slightly in February, falling to 0.52% from 0.53% the previous month, nearly matching its year-ago rate of 0.51%. The number for bank cards rose slightly to 2.15% from 2.02% the previous month. The bank-card default rate was last this high in August 2021, when it was 2.35%.