Three classes of Structured Asset Securities Corp. residential mortgage-backed certificates have been downgraded by Fitch Ratings.The downgrades were as follows: series 1999-SP1 pools 1, 2, and 3, class B, from BBB to BB-plus; series 2002-BC1, class M3, from CCC/DR2 to CC/DR2; and series 2002-HF2, class B2, from B to CC/DR2. In addition, the Distressed Recovery rating of series 2003-BC2 class B2 was changed from DR6 to DR2. Fitch also upgraded two SASCO classes and affirmed the ratings on 49 classes from 15 SASCO deals. Fitch attributed the downgrades to deterioration in the relationship between credit enhancement and expected losses.

-

Federal Reserve Vice Chair for Supervision Michelle Bowman said in a speech Monday morning that the central bank will introduce two capital proposals that she said are aimed at boosting banks' role in the mortgage market.

8h ago -

The Public Interest Law Center filed an amicus curiae brief arguing against a joint motion to end a redlining agreement early against Lakeland Bank.

10h ago -

The mortgage broker trade group put out a white paper calling for lowering transaction costs, increasing housing supply and reducing regulatory barriers.

February 13 -

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

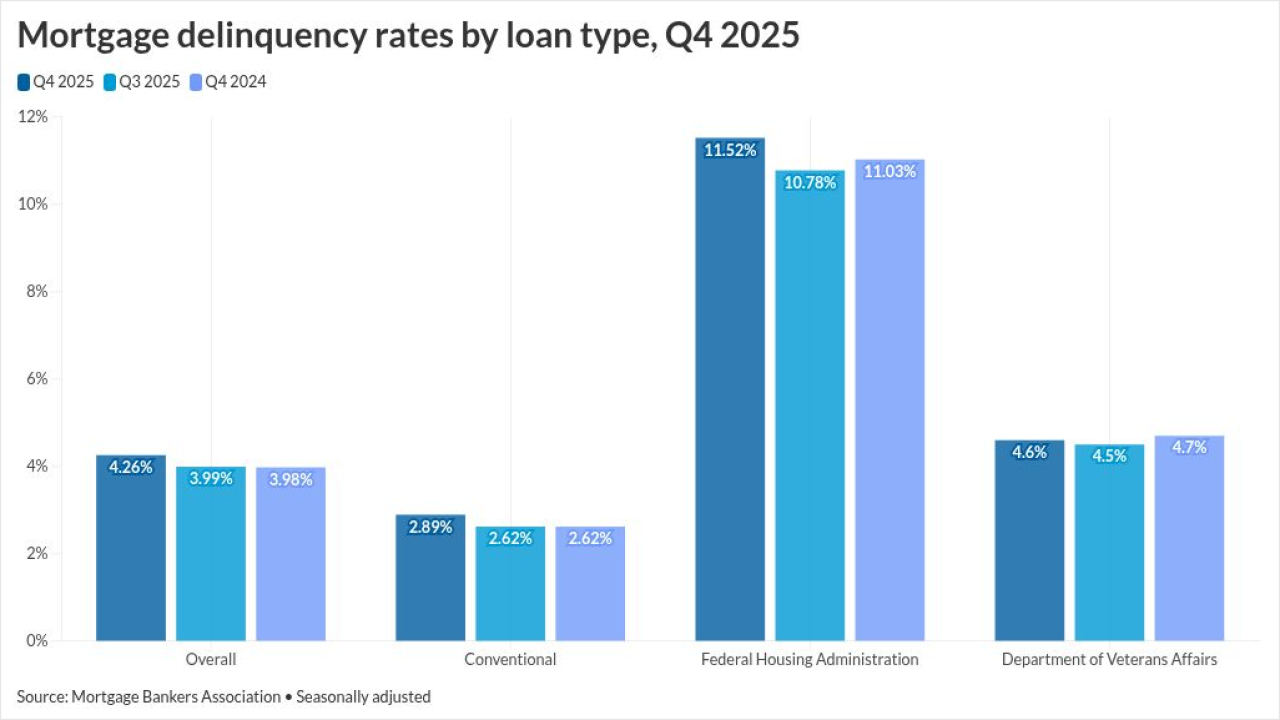

Mortgage delinquencies increased across loan types, and while 30-day late payments showed overall improvement, later-stage distress worsened.

February 13 -

The Bureau of Labor Statistics released its January Consumer Price Index Friday, showing that inflation rose 0.2%, while the annual rate eased to 2.4% after holding at 2.7% for several months. The data reduces the likelihood that the Federal Reserve will cut interest rates in the near future.

February 13