The fourth quarter was the second-best ever for earnings at Flagstar Bancorp, but its mortgage business had lower revenue compared with the prior period as gain-on-sale margins dropped.

Flagstar reported net income of $154 million for the fourth quarter, compared with its best-ever $222 million in the third quarter and $58 million for

Even with the lower revenue, the three aspects of the mortgage business Flagstar participates in — originations, servicing and providing warehouse credit — were bright spots in the fourth quarter.

"Our mortgage team continues to deliver, achieving revenues of $232 million for the quarter," Alessandro DiNello, Flagstar's president and CEO, said in a press release. "While gain-on-sale margins did compress, we were pleased with how well they held up, finishing at 1.93% for the quarter."

The fourth-quarter mortgage revenue was down from $358 million in the third quarter, but well above the $98 million the segment reported one year ago. The quarter-to-quarter drop was attributed to a 38-basis-point decrease in the gain-on-sale margin, Flagstar said. In addition, it had zero net return on its mortgage servicing rights, a drop of $12 billion compared with the third quarter, as loan prepayments continued to be elevated.

Because of those prepayments, Flagstar's servicing portfolio fell to $226.7 billion in the fourth quarter from $227.4 billion at the end of the third quarter and $228.2 billion on Dec. 31, 2019.

But there was a shift in the composition of the servicing portfolio. While Flagstar's strategy normally involves selling off the rights it generates and retaining the subservicing function, it held on to more of the rights over this period.

On Dec. 31, Flagstar subserviced $178.6 billion. It also serviced $38 billion of MSRs it owns, in which the loan was sold on the secondary market. One year prior, that split was $194.6 billion of subservicing, but just $24 billion of MSRs the bank owned.

The servicing portfolio also has $10.1 billion in portfolio mortgages, up from $9.5 billion on Dec. 31, 2019.

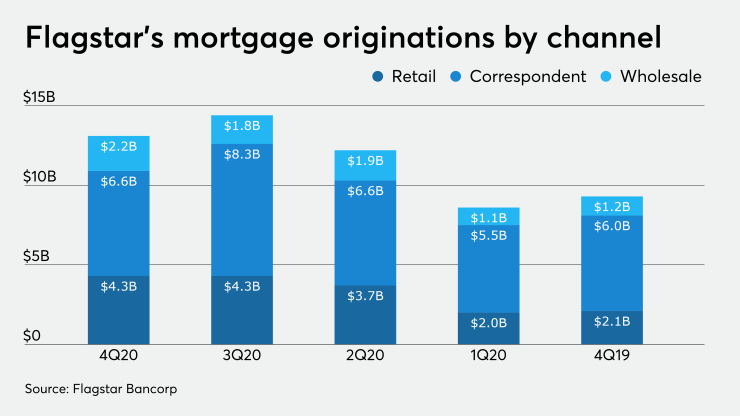

Origination volume in the fourth quarter was $13.1 billion, down from $14.4 billion in the third quarter, but up from $9.3 billion for the fourth quarter of 2019.

However, there are indications that Flagstar's focus may have shifted as

But the pullback in government-guaranteed lending was apparent when comparing these earnings with last year's numbers, as Flagstar did approximately $500 million during the fourth quarter, up from $300 million in the third quarter, but below the $2 billion originated in the fourth quarter of 2019.

By channel, correspondent purchases fell to $6.6 billion from $8.3 billion in the third quarter, but up from $6 billion in the fourth quarter of 2019. Retail was flat on a quarter-to-quarter basis, at $4.3 billion; one year prior, it was just $2.1 billion.

However, the wholesale channel increased its volume to $2.2 billion in the fourth quarter, versus $1.8 billion in the third quarter and $1.2 billion during the fourth quarter of 2019.

Flagstar's

Warehouse lending, along with lower deposit costs, was the driver of the $9 billion quarter-to-quarter increase in net interest income at Flagstar.

"Our impressive performance in warehouse, coupled with a concerted effort to reduce funding costs, resulted in a flat net interest margin," DiNello said. "In fact, net interest margin actually expanded 4 bps when excluding those loans with government guarantees where we have the right to repurchase."

The average warehouse loan balance during the fourth quarter was $6.9 billion, up from $5.7 billion three months prior.