Unemployment lows and increased home equity paved the way for the lowest mortgage delinquency rates seen in 11 years, according to CoreLogic.

The foreclosure inventory rate fell 0.2% to 0.6% year-over-year in March, which was the lowest reading for the month in 11 years. The foreclosure inventory rate has held steady at 0.6% since August.

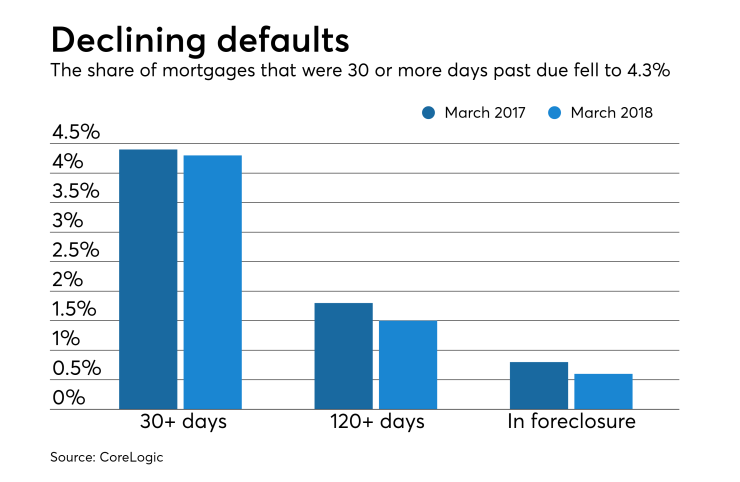

The early-stage delinquency rate, which serves as an indicator of mortgage market health, held steady at 1.7% in March from a year ago. For mortgages that were 60-89 days past due, the share also remained unchanged at 0.6%.

The serious delinquency rate, regarding mortgages 90 or more days past due, including those in foreclosure, fell from 2.1% to 1.9%; this is the lowest reading for the month of March since 2007 when it was 1.5%.

"Unemployment and lack of home equity are two factors that can lead to borrowers defaulting on their mortgages," Frank Nothaft, chief economist for CoreLogic, said in a press release.

"Unemployment is at the lowest level in 18 years, and for the first quarter, the CoreLogic Equity Report revealed record levels of home equity growth with equity per owner up $16,300 on average for the year ending March 2018," he said.

The share of mortgages that transitioned from current to 30 days past due ticked up from 0.6% to 0.7% annually. For context, this transition rate was 1.2% in January 2007, just before the start of the financial crisis, and peaked at 2% in November 2008.

The share of mortgages in some stage of delinquency in March declined to 4.3% from 4.4% a year ago and from 4.8%

While delinquencies are down overall, the upcoming hurricane season could signal growth in mortgage defaults.

"As we enter the summer, the risk of hurricane and wildfire damage to homes increases as does the risk of damage-related loan default," said CoreLogic President and CEO Frank Martell.

"Last year's hurricanes and wildfires continue to affect today's default rates. Serious delinquency rates are more than double what they were before last autumn's hurricanes in Texas and Florida. The serious delinquency rates have also quadrupled in Puerto Rico," Martell explained.