The

Listing all the homes connected with seriously delinquent loans or foreclosures evenly over the course of a year would add only half a month of supply, according to a new Moody’s Investors Service’s analysis of data from mortgage and Realtor trade groups.

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of supply at a historically-low three months, and it is in line with

“I do think that we’re not in a 2008 or 2009 mass foreclosure incident,” said Sadie Gurley, vice president at Maxwell Capital, in a recent interview, noting that this may disappoint some distressed asset investors hoping for a higher number of homes they could buy at discounts.

A larger foreclosure wave would have offered investors like

However, the fact that the additional supply will leave inventory in the housing market relatively tight and prices high also has an upside for these investors.

“Significant home price growth will allow SFR owners to trade some of their older properties for younger stock that requires less capital expenditures,” the analysts noted.

How many foreclosure properties ultimately get listed depends on the extent to which roughly 2.6 million at-risk borrowers can recover the ability to make payments on their loans.

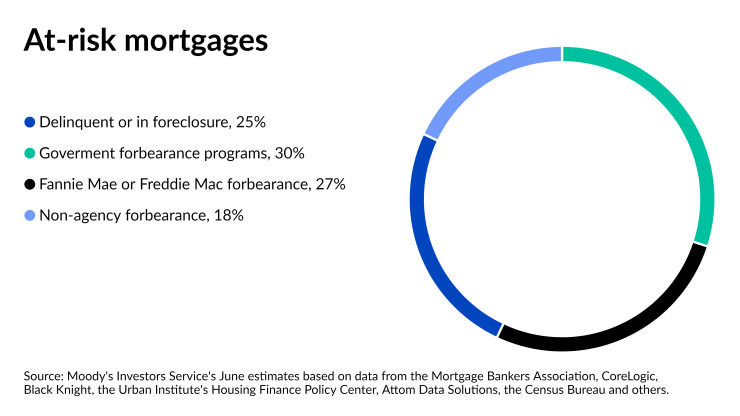

Around three quarters of these borrowers have temporarily suspended their payments for pandemic-related hardships through either government-related or private programs, according to Moody’s analysis. The remaining 25% are delinquent or in foreclosure.

The percentage of at-risk borrowers in government forbearance programs is 30%. Another 27% of distressed homeowners have postponed their payments on government-sponsored enterprise mortgages, and 18% have non-agency loans in forbearance.

Whether the borrowers with suspended payments can get back on track depends in part on the extent to which the job market makes up for its losses from the pandemic, and whether it does so before relief programs end. After that, the question of when distressed homes will list depends on foreclosure timelines that vary by jurisdiction, with states that lack a court process being the quickest to move.

As a result, the earliest foreclosures likely won’t begin until the first quarter of 2022, and by then, 69% of the jobs lost in the pandemic should be recovered, according to Moody’s.

“Home losses will start becoming unavoidable for certain borrowers in states with nonjudicial foreclosure processes by early next year,” Moody’s analysts said in the report.

Nearly all jobs should be recovered by the second quarter of 2023, according to Moody’s. Current estimates suggest roughly 43% of jobs have been recouped thus far.