With the federal

Mortgage servicers finalized the foreclosure process on 3,027 properties during the month, up

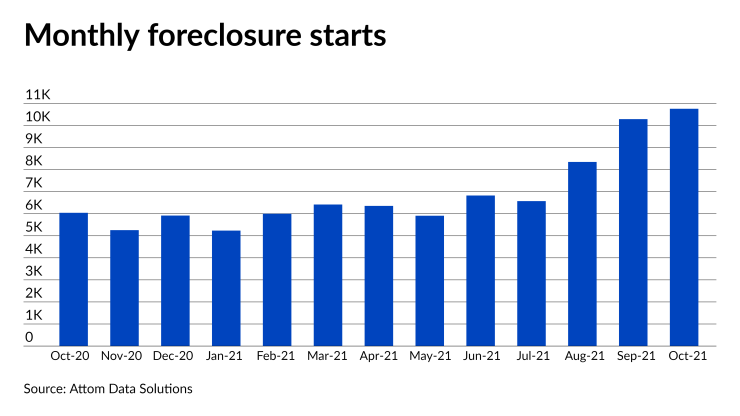

Filings — defined as default notices, bank repossessions or auctions — totaled 20,587 housing units, up 5% month-over-month and 76% year-over-year. Starts grew for the third consecutive month while October represented the sixth in a row for increased filings. Most of the activity related to vacant and abandoned homes that sat in a stage of foreclosure entering the pandemic, according to Rick Sharga, executive vice president at Attom affiliate RealtyTrac.

“Most foreclosure activity for the next few months is likely to be foreclosure starts, since virtually nothing entered the foreclosure process during the past year,” Sharga said in the report. “The ratio of foreclosure starts to foreclosure completions will normalize over time as we get back to normal levels of activity.”

At the state level, Illinois once again had the most bank repossessions with 1,075 in October, greatly outpacing the next largest amounts by state, California’s 178 and Pennsylvania’s 175. Pennsylvania saw the largest increase in starts, up 107% month-over-month, followed by 104% in North Carolina and 61% in New Jersey. Broken down by the 220 housing markets Attom tracked, the most starts came in New York with 667, Miami with 622 and Los Angeles with 430.

Overall, one in every 6,675 mortgaged properties had a foreclosure filing in October. Illinois had the lowest ratio at one in every 1,923 units, ahead of Florida’s one in every 3,180 and New Jersey’s one in every 3,438. St. Louis had the highest foreclosure rate among metropolitan areas with one in every 1,138, followed by Trenton, N.J.’s one in every 1,293 and Miami’s one in every 2,233.