Freddie Mac's effort to prop up the pricing of its newly issued mortgage-backed securities is working, according to a company official.Over the past four months, the pricing of Freddie's "to-be-announced" mortgage securities (which the company calls participation certificates) has improved by 4/32nds, according to Mike May, senior vice president for mortgage sourcing, operations and funding. On Oct. 29, Freddie announced that it would begin purchasing its own PCs, which generally trade at a discount to Fannie Mae mortgage-backed securities. Freddie said that to fund these purchases, it would sell its holdings of Fannie Mae MBS. The results have been "most encouraging" and bond market analysts are starting to notice, Mr. May told reporters at the Mortgage Bankers Association secondary market conference. Freddie officials would not disclosure the amount of their PC purchases.

-

Judges on the U.S. Court of Appeals for the District of Columbia struggled to find a resolution to an injunction issued last year that halted reductions-in-force by the Consumer Financial Protection Bureau.

2h ago -

The Federal Housing Finance Agency said it is reviewing more than 9,000 pages of records tied to fraud tips submitted through a hotline launched last April.

3h ago -

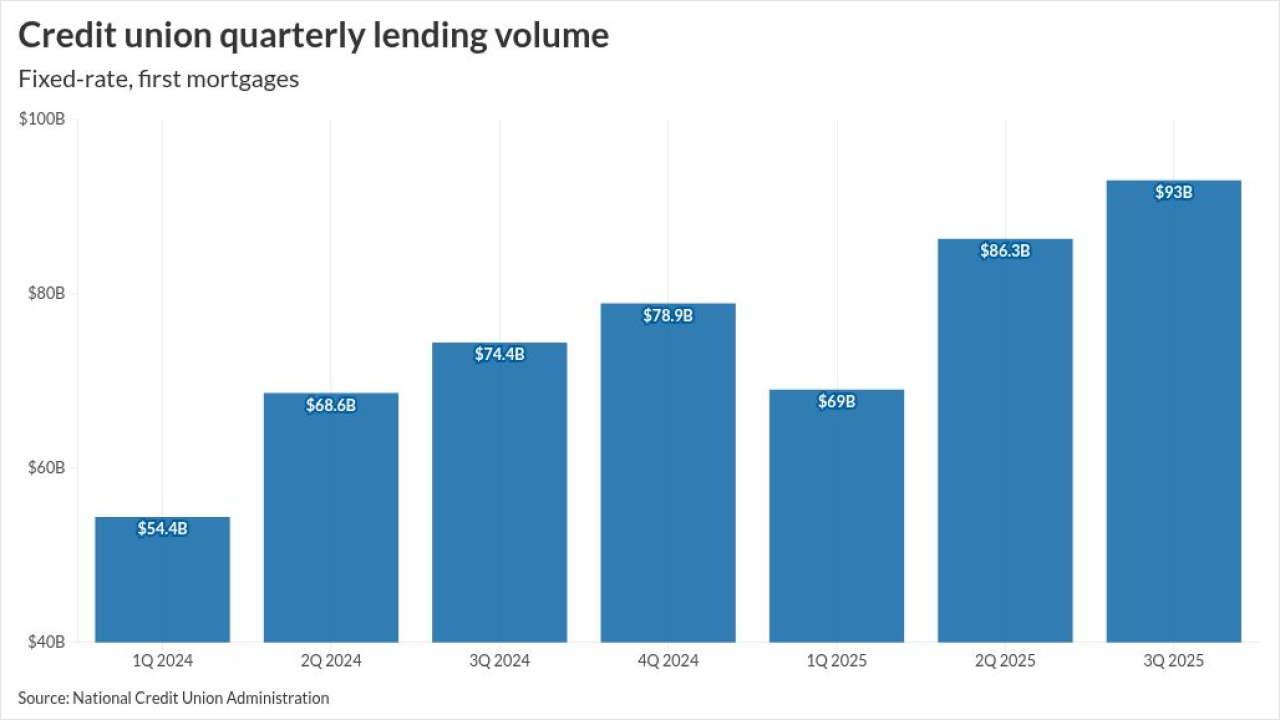

The agreement between servicing technology platform Vertyx and Great Lakes Credit Union arrives as the mortgage industry sets its focus on borrower retention.

4h ago -

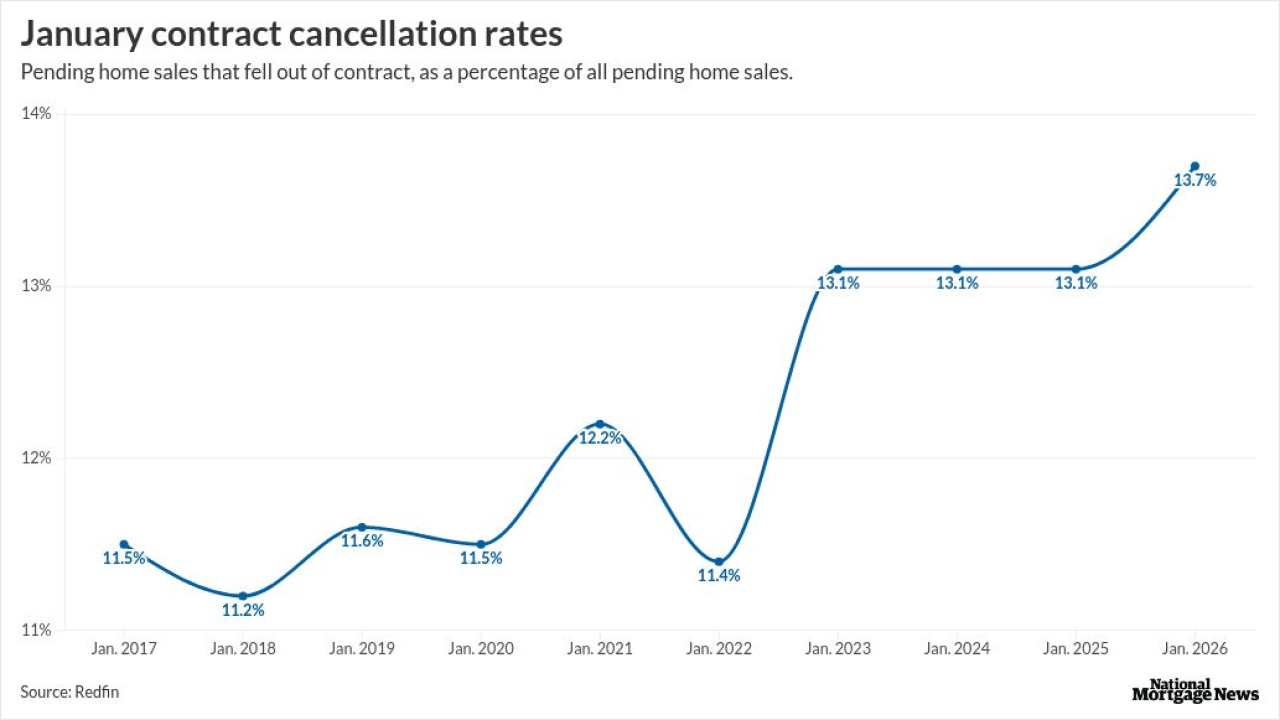

Nearly 14% of homes that went under contract last month were cancelled, up from 13.1% last year and the highest January share in records, according to Redfin.

5h ago -

Federal Reserve Gov. Lisa Cook said AI could boost productivity, but warned the transition may raise unemployment and force difficult tradeoffs between inflation and jobs.

6h ago -

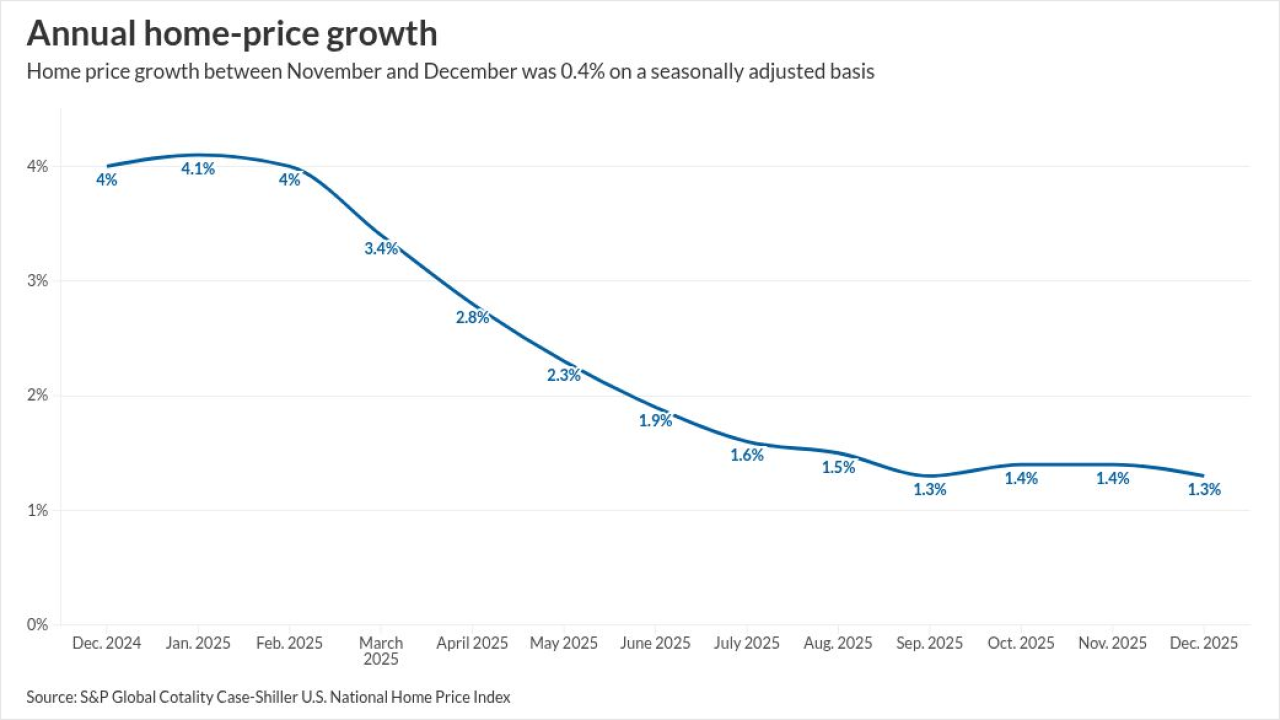

Home prices edged up nationwide, but gains were modest and uneven. Major indexes agree on direction, differ on size, as 2025 posted weak growth.

9h ago