Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call Wednesday.

"I won't forecast the point when we will have enough capital to exit conservatorship, but I will tell you it will be as soon as we responsibly can," he said.

The government-sponsored enterprise recently was authorized to retain more than $3 billion in capital for the first time in over a decade. The company now holds more than $6 billion in equity, but the Federal Housing Finance Agency is expected to require it hold much more when it finalizes a pending GSE capital rule.

While more capital is still needed, the lifting of the past restriction marks an important step further away from the era when the financial crisis forced the GSEs into conservatorship and government officials shrunk their portfolios to reduce taxpayer risk, prioritizing the payment of dividends to the Treasury instead.

While the shift to capital retention represents a big change in Freddie Mac's ultimate goal, generating relatively stable earnings will continue to be a key means through which the GSE can achieve its end, Brickman noted.

"We continue to reduce risk through our credit risk transfer activities and our credit quality remains strong. This consistent business performance should help us achieve our top priority of exiting conservatorship more quickly," he said.

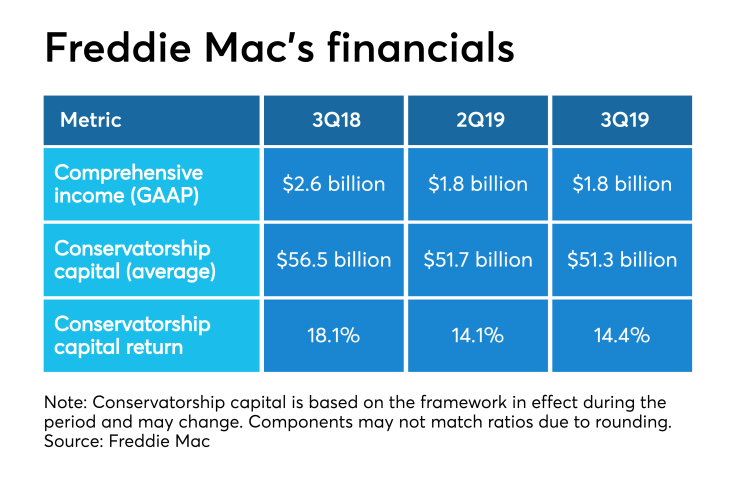

Freddie Mac generated $1.7 billion in net income ($1.8 billion in comprehensive income) between July and September. That number compares to from $1.5 billion (net) and $1.8 billion (comprehensive) during

Freddie's preliminary measure for return on modeled capital as calculated under its conservator's capital framework during the third quarter was 14.4%. Its return on conservatorship capital was 14.1% as calculated in the second quarter, and was 18.1% in the third quarter of last year. The 3Q18 figure was downwardly revised to include capital for deferred tax assets.

Freddie has been reporting ROCC as a proxy for what its return on equity might like be in the private market.