Freddie Mac on Nov. 15 will lower

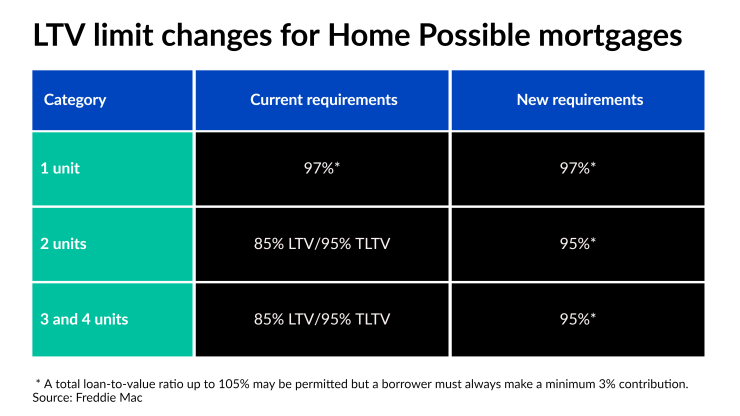

For 2- to 4-unit homes, maximum loan-to-value ratios have been limited to 85% unless second lien products that have been difficult to obtain in the private market were taken out, in which case the total LTV limit has been 95%. The change increases the limit to as high as 105% for borrowers getting down payment assistance from a subsidized source such as a state housing agency while ensuring that, at a minimum, borrowers must contribute funds equal to at least 3% of the loan amount. Borrowers without subsidized down payment assistance will have a maximum 95% LTV after the new requirements go into effect.

The pending changes to underwriting through Freddie’s Home Possible program are aimed at fulfilling the Biden administration’s recently announced

“For 2 to 4 units, you’ve needed a significant down payment unless you had a second lien that was often impractical to get, so this makes a pretty big difference,” said Daniel Jacobs, managing director at TruLoan Mortgage in Charlotte, N.C., a lender active in the Southeast and Midwest. “It allows people to build wealth by leveraging additional income-producing units when they buy a home.”

Freddie will also change LTV calculations used for manufactured homes with less than one year of seasoning in order to give borrowers more access to the relatively lower-rate financing the government-sponsored enterprise provides for loans deeded as real property.

The change will make it possible to use the appraised value of both the land and newly installed home to determine LTV, even if a loan does not yet have one year of seasoning. Currently, prior to hitting the one-year mark, a complicated formula wherein the acquisition costs of the land are factored is used to lower the valuation.

“This makes it much, much easier for people that are pursuing manufactured homes to obtain conventional financing,” Jacobs said.

The new underwriting guidelines are effective for loans that settle on or after Nov. 15.