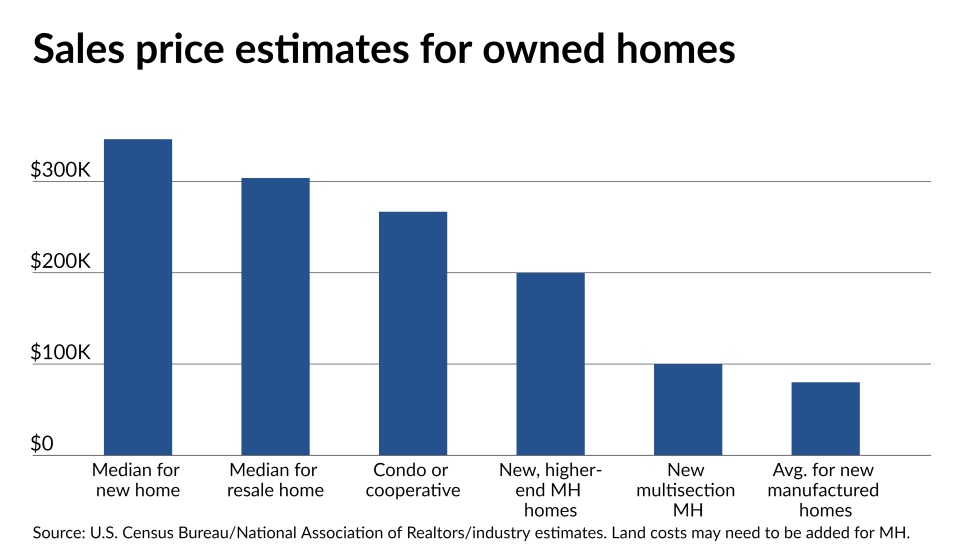

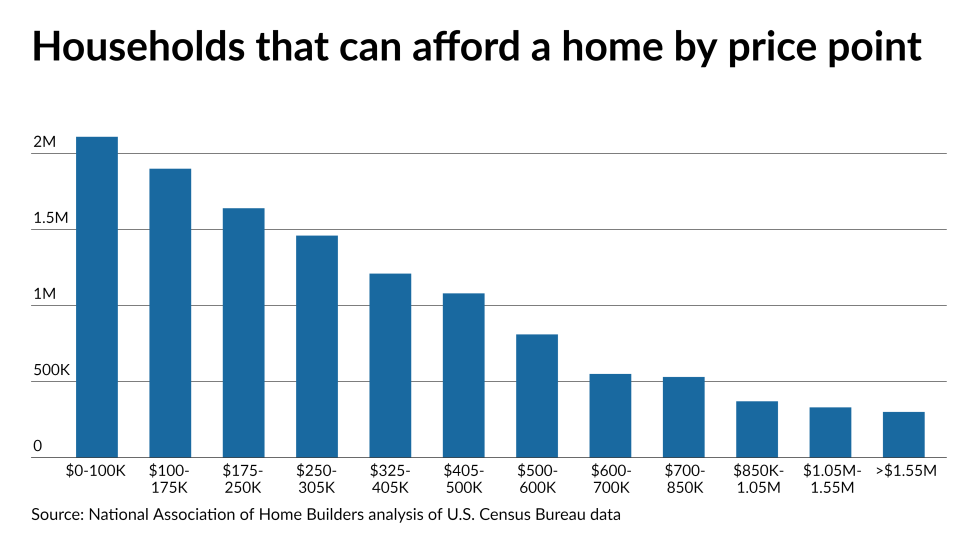

Mortgage lenders who have traditionally been reluctant to go too far down in the home price spectrum are increasingly interested in manufactured homes as elevated unemployment, inventory shortages, rising prices and higher rates make traditional houses less accessible to a growing number of borrowers.

From the slightly higher-end structures that rival site-built houses to the smallest single-section manufactured home, mortgages for these types of home have become more attractive to lenders who are using them to reach more buyers and offset dwindling refinancing.

“They [lenders] are offering both [higher- and lower-end manufactured homes], but when COVID hit, demand for traditional singlewides and doublewides really picked up,” said David Battany, an executive vice president of capital markets at Guild Mortgage, noting that loans are increasing important as lenders become more reliant on purchase volume. “We’re big believers [in the idea that] manufactured housing is a big part of the solution to lack of supply.”

While relatively few traditional mortgage lenders fund manufactured housing, some interest has picked up in recent years as the government-sponsored enterprises have increased the attractiveness of financing in the market, partly due to a legislative mandate called Duty to Serve, which requires Fannie Mae and Freddie Mac to support a secondary market for mortgages on housing for very low-, low-, and moderate-income families in manufactured housing, affordable housing preservation, and rural housing.

“There’s a

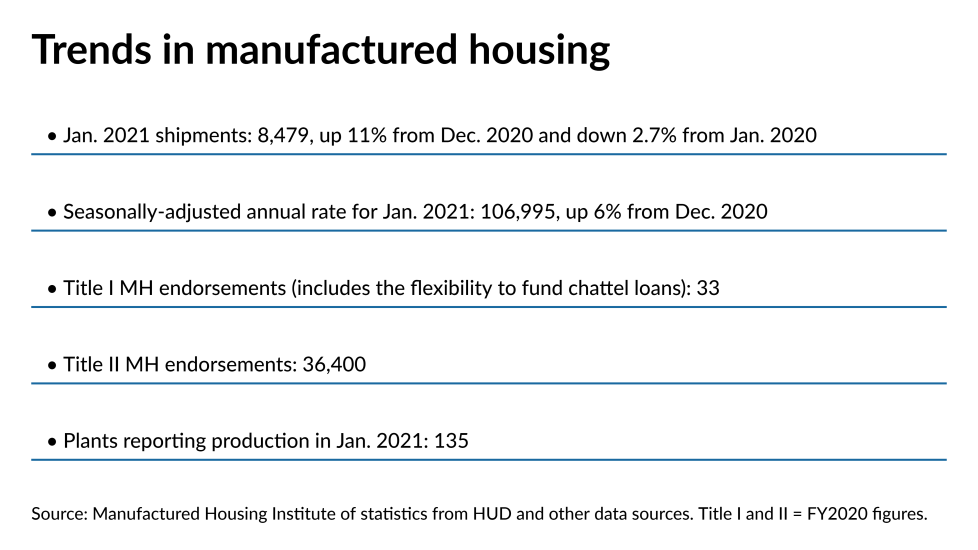

The GSEs’ increased involvement, in combination with government programs called Title I and Title II, the former of which allows the flexibility to lend on land and/or the MH unit alone, have helped fuel growth in the niche, according to American Financial Resources, a lender that specializes in the product.

“At AFR, we’ve seen an increase of more than 10% in loan volume specifically for manufactured homes, year over year, for the last two years,” said President Laura Brandao in an email.

The GSEs are reporting gains in manufactured home loan volumes as well.

“From the start of Duty to Serve in 2018 to the end of last year, we saw a 27% increase in the number of single-family customers who delivered a manufactured housing loan,” said Patrick McCarthy, vice president at Fannie Mae, in an email.