Freddie Mac resumed quarterly reporting for the first time since 2002, citing a net loss of $211 million ($0.46 per share) that it attributed primarily to mark-to-market losses on its derivatives portfolio and credit spread widening.Freddie Mac also reported that it recorded net income of $2 billion ($2.80 per share) in the first quarter of 2006. Richard Syron, Freddie Mac's chairman and chief executive officer, noted that "[h]ousing prices declined, mortgage credit tightened, and credit spreads and OAS spreads widened" in the first quarter, which he termed a "very challenging period" for the housing and mortgage markets. "As you can see in our GAAP and fair-value results, we were affected by these changes," he said. "Despite these headwinds, Freddie Mac gained ground last quarter." Guaranteed portfolio volumes rose 16% on an annualized basis, resulting from a shift in mortgage originations back to long-term fixed-rate products, which Mr. Syron characterized as Freddie Mac's "sweet spot." The increase "has enabled us to regain some share from the private-label market and to grow at twice the rate of the market as a whole," he said. "Importantly, we have achieved this growth while maintaining a more cautious view than most towards credit risk. This has helped our aggregate credit statistics, such as delinquencies, to stay lower than the market as a whole."

-

While federal examination and investigative activity has all but stopped, the regulator is still providing regulatory guidance to the industry.

3h ago -

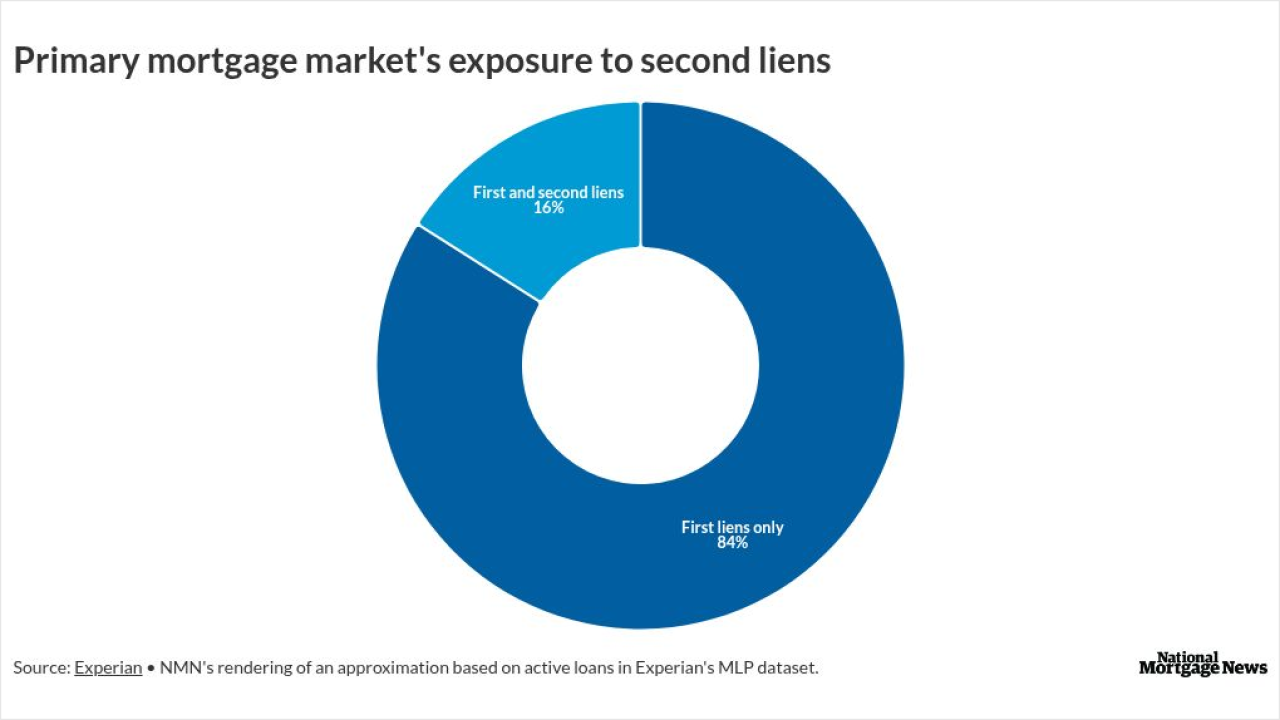

Agency MBS investors have had limited information about primary loans coexisting with home equity products, and may want to get more now, according to Experian.

March 11 -

A near-record share of homeowners unable to sell their properties are renting them out instead, with "accidental landlords" accounting for 2.3% of listed rental stock in October, per Zillow data.

March 11 -

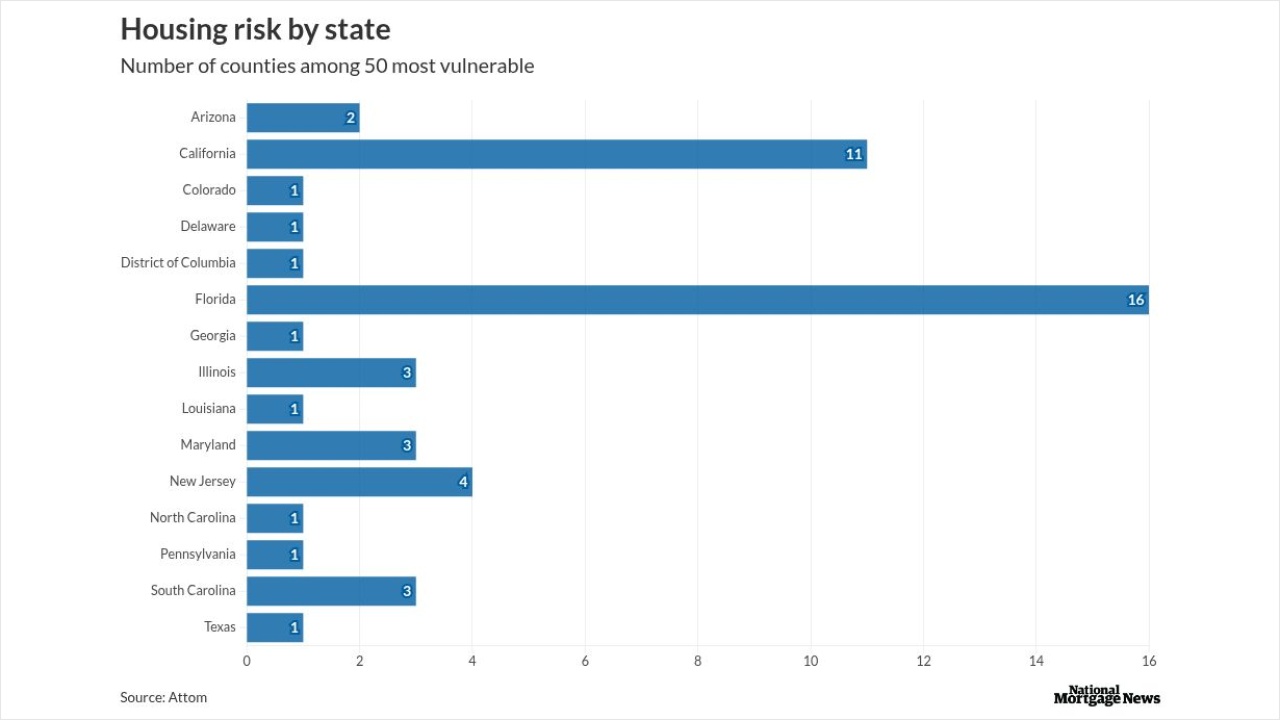

Residents in more than half of U.S. counties need greater than one-third of income to successfully manage major housing costs, according to new Attom research.

March 11 -

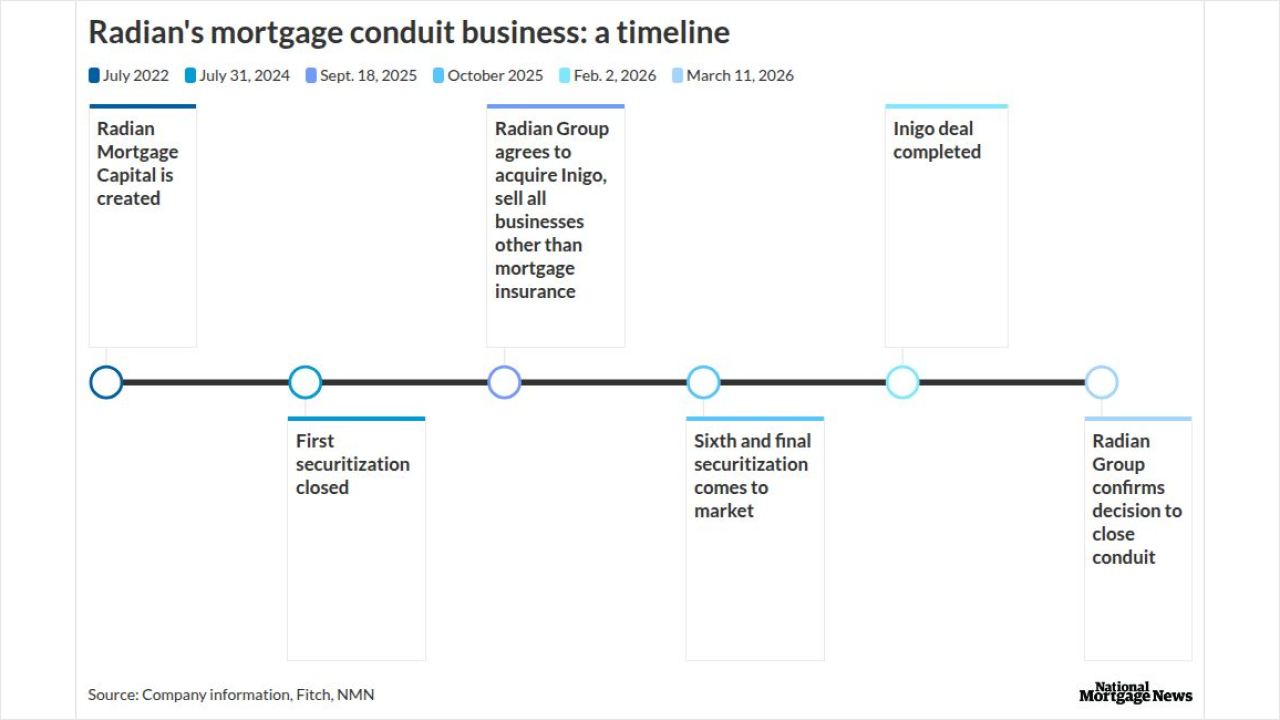

Radian Group was looking to sell the aggregator, along with its title and real estate units, following a business model pivot related to the Inigo buy.

March 11 -

Some of the best mortgage companies to work for discuss how they incorporate community service in their plans and the resulting business and personnel benefits.

March 11